4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -2.2619

The British pound started a new round of upward movement on Tuesday. In principle, if the movement of the pair over the past month and a half can not be called an absolute flat, then it is absolutely accurate and not a trend movement. At the same time, the upward trend is absolutely preserved, since we have not seen a normal correction. Therefore, there is no evidence yet that the upward trend is complete. The pair is only consolidating in a relatively narrow side channel. The previous local lows were never worked out or overcome. But at the same time, there are also a large number of factors that speak in favor of resuming the upward trend. In an article on the euro/dollar, we described in detail all the crises and problems that America is currently facing. Formally, they may well cause new sales of the US currency. But we should also take into account the fact that the US dollar has already fallen quite significantly, which makes the bulls think several times before opening new long positions. So in a sense, we are witnessing a new paradoxical situation where traders simply refuse to sell a few despite the fact that there are a lot of technical reasons. All the fundamental reasons for the growth have already been practiced several times, and in a situation specifically with the pound, the pair should have begun to fall long ago since in the UK, problems are slightly less than in the States.

Meanwhile, in the US, President Donald Trump said that he was ready to completely end any cooperation with China. As reasons, Trump cited "unfair treatment of the US", "loss of billions of dollars from unfair trade with China", "excessive dependence on China", and "the Chinese virus". It is absolutely unclear how the American President is going to simply stop any cooperation with a country that is his country's largest trading partner. Let's say that Trump is re-elected for a second term and somehow persuades all American companies whose production is located in China to return production facilities to the United States. But what about, for example, the sale of farm products? After all, China will impose retaliatory sanctions and take retaliatory measures. In fact, any action that Washington does not favor China will provoke a response. The US President cannot fail to understand that he will make it worse not only for China, but also for America. At the same time, with reference to the US trade representative Robert Lighthizer, the media got information that the US and China held telephone talks and were satisfied with the implementation of the first phase of the trade agreement, which was signed on January 15. Lighthizer himself stated: "Both sides see progress and are committed to taking the necessary steps to ensure the success of the agreement." At the same time, it is reported that China does not fully comply with the terms of the deal, as the global epidemic of "coronavirus" has made its adjustments. Beijing was supposed to increase annual purchases of American products to $ 200 billion, which did not happen. Well, Donald Trump says that the second phase of the trade agreement will not be discussed in the near future, because he "can't forgive China for what it did to America" (meaning the pandemic and the economic crisis caused by it). This is a set of statements and actions that are essentially opposite.

Meanwhile, nothing interesting is happening in the UK itself. It might even be a good thing. In some EU countries, 5-15 thousand new cases of the disease are already registered every day, so it is good that the pandemic has receded in Britain and is not yet returning. Otherwise, the British economy could suffer a new blow. In the Foggy Albion, no more than 1.5 thousand new cases of "coronavirus" are recorded daily, which is an absolutely acceptable figure. On the other hand, Britain has faced so many problems in recent months and even years that it hardly needs additional blows of fate. We have already said that the national debt in the country continues to grow and recently exceeded 2 trillion for the first time in its history. There have been no trade deals with the European Union and the United States, and there are no preconditions for their conclusion in the near future either. Thus, the British economy is experiencing serious problems that will only get worse from January 1, 2020. Thus, despite the fact that the pound has been doing just fine in recent months, its prospects remain vague and uncertain. And only the general situation in the US and its "four crises" do not allow the British to start a new fall, which would be no less logical than the fall of the US currency in recent months.

From a technical point of view, the pound/dollar pair continues to "swing" with the full preservation of the upward trend. Thus, the upward trend can resume at any time. But a new downward trend, which has been brewing for a long time, can be identified by overcoming past local lows. However, at the moment, the bears have serious problems even getting close to them. Thus, despite several price fixes below the moving average in recent weeks, the downward movement has not started, and sellers continue to show their weakness and unwillingness to conduct active trading from time to time.

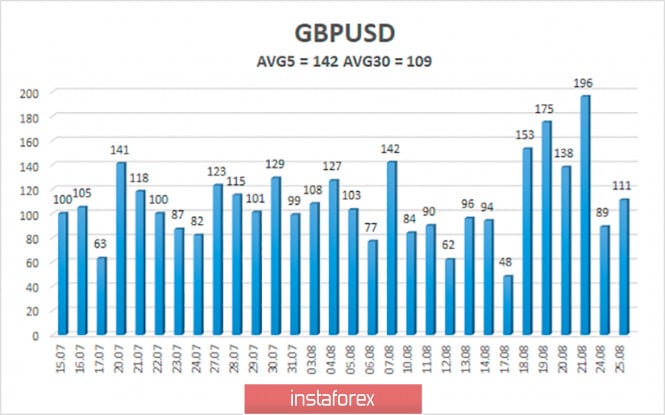

The average volatility of the GBP/USD pair is currently 142 points per day. For the pound/dollar pair, this value is "high". On Wednesday, August 26, thus, we expect movement within the channel, limited by the levels of 1.2989 and 1.3273. Turning the Heiken Ashi indicator downward will indicate a possible new round of downward movement.

Nearest support levels:

S1 – 1.3123

S2 – 1.3062

S3 – 1.3000

Nearest resistance levels:

R1 – 1.3184

R2 – 1.3245

R3 – 1.3306

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe is constantly trying to start a new downward trend, but so far to no avail. Thus, today it is recommended to consider short positions with the goals of 1.3062 and 1.3000, if the bears again manage to secure the pair below the moving average. At this time, it is recommended to trade the pair for an increase with the goals of 1.3184 and 1.3245, as the price has returned to the area above the moving average line.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment