US stocks hit record levels on Tuesday due to positive trade negotiations between the US and China. At the same time, the growth of stock indexes is not based on the real state of the US economy and is much more a consequence of fiscal and monetary stimulus.

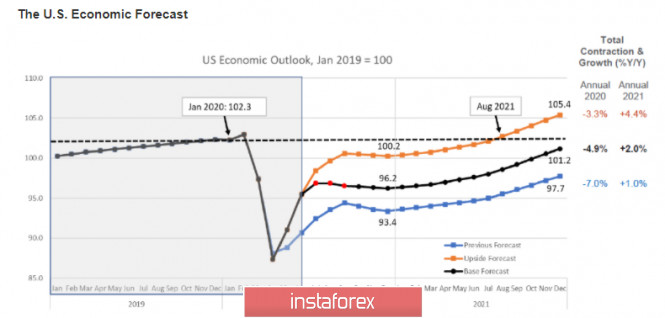

According to the Conference Board, consumer confidence in the US declined by 6.9 points in August and reached a 6-year low, which has been recorded for the second month in a row. In addition, the consumer optimism about the short-term and financial prospects also continue to decline. These results are expected. Considering an optimistic scenario on the recovery rate of the US economy, the Conference Board sees an exit to the level of January 2020 at least in August 2021. But if the scenario is negative, the recovery is postponed until 2023.

In these conditions, we should focus our attention on what measures are being taken by the Fed to overcome the crisis. Before Powell's speech in Jackson Hole, it is unlikely that the current range will be broken, so we should get ready for strong movements before this week ends.

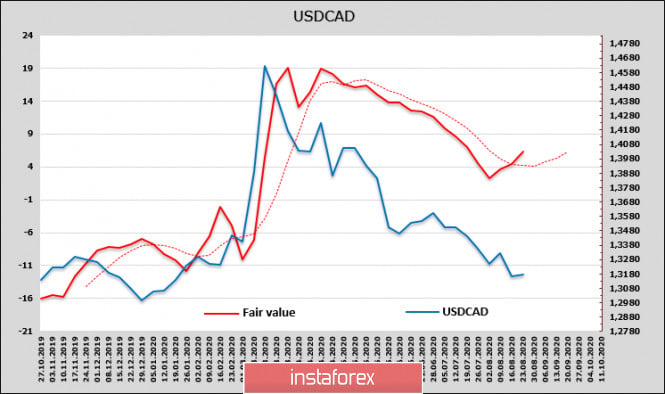

USD/CAD

The calculated price continues to make an upward turn, which indicates an approaching reversal in the spot as well. Following the CFTC report, net short position of CAD rose by 329 million and amounted to 2.55 billion for the reporting week, that is, large speculators are gradually increasing their rates for selling the Canadian currency.

On the other hand, Governor of Bank of Canada, Macklem, will speak at a virtual symposium in Jackson Hole immediately after Powell, so we should not expect any strong movements until Thursday evening. Due to this situation, any macroeconomic news is not significant anymore. The Fed's position, which is expected to be announced at the symposium, is the only driver left on the markets that can lead to a global repositioning.

At the same time, it can be noticed from the dynamics of the estimated fair price that investors are leaning towards a strong dollar. If so, the level 1.3130 will be the base, from which the bullish impulse will be counted. The nearest resistance zone is 1.3230/40, breaking through it will open the way to the next target - 1.3314.

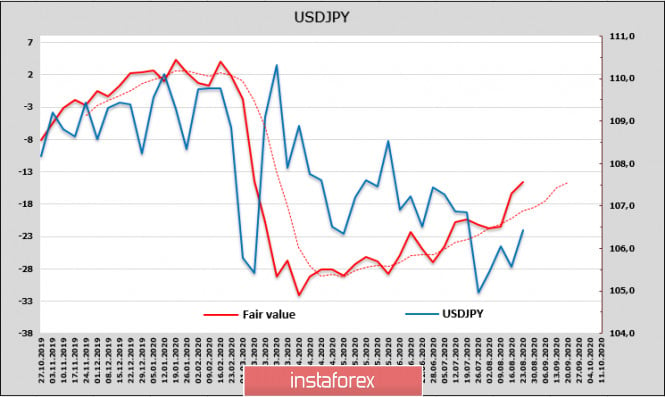

USD/JPY

The yen's long position is declining rapidly, which decreased by 730 million during the reporting week. Although the advantage is still behind the yen, increasing data points to a reversal in favor of the dollar. If the calculated price goes up, the spot will follow.

Adding to the obvious driver in the form of Jackson Hole, the yen will receive its own internal signal on Friday, which can adjust the positions of investors – data on consumer prices in the Tokyo area, which usually serve as a benchmark for assessing inflation. The forecast is moderately positive, in any case, it is not expected to slide into deflation.

Japanese society is dominated by a completely unique assessment of the current economic crisis. It seems that people have forgotten that it did not arise as a result of the spread of the coronavirus, but long before it. Opinion polls show that a large majority believe that a new state of emergency should be imposed due to fears of a second wave of pandemic. At the same time, Mizuho Bank believes that it is quite clear that slowing down economic activity is necessary until the pandemic ends.

Thus, the Bank of Japan's monetary policy cannot normalize, which means that there are simply no internal reasons for the yen to strengthen. The society expects the economic crisis to further develop, since there is no vaccine. In these conditions,the weakening of the yen is the only possible way to keep Japanese manufacturers afloat.

On Wednesday morning, the USD/JPY rate reached the middle of the rising channel 106.58, from where we can consider two possible ways. An unlikely scenario is a pullback to the lower border of the channel to the 105.60/70 zone, and a more likely scenario is a movement to the upper border of 107.60 / 80.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment