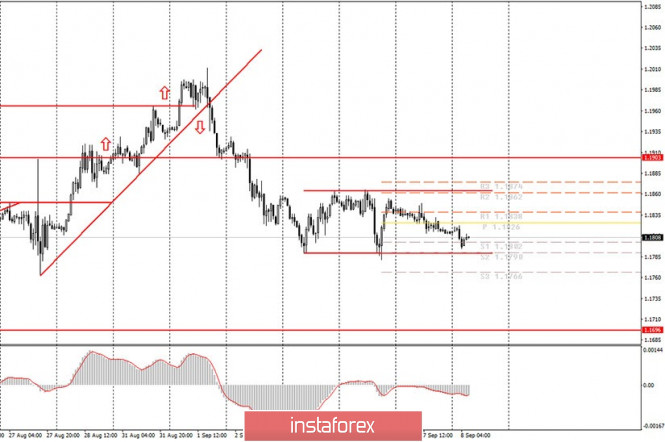

Hourly chart of the EUR/USD pair

The EUR/USD currency pair spent night trading in the same narrow side channel in which it had traded for the previous three days. This channel is capped at 1.1790 and 1.1865. Therefore, as of Tuesday morning, the technical picture of the pair has not changed at all. In our recent articles, we advised novice traders to trade short while aiming for the lower channel line at 1.1790. In particular, we advised you last night to set Take Profit orders around 1.1790 and Stop Loss orders to zero on open trades for sell positions and go to sleep. Basically, as we can see this morning, the quotes have almost reached the 1.1790 level. Therefore, traders had the opportunity to earn several tens of points both yesterday and today. Thus, you can close short positions and wait for new signals here. There may be only two of them during the course of the day. Either the pair will leave the side channel through its lower line, which will make it possible to resume trading downward with the target of 1.1700 (the lower boundary of the senior side channel), or it will rebound from 1.1790, which will allow you to buy long to the top line of the lower side of the channel 1.1865.

Today, novice traders can pay attention only to the report on the EU GDP in the second quarter, which we already mentioned in yesterday's evening review. We believe that traders will only react to this report if the real value of the indicator in the second assessment differs from the forecast. For example, if the real value improves from -12.1% q/q to -11%, then traders might perceive this as a positive moment, and the euro may start growing during the day. We do not expect a significant reaction, the movement is unlikely to be strong, since there will hardly be a big difference from the GDP value a month ago (first estimate). Nevertheless, this indicator is important, you should not skip it. In addition to this report, we recommend that you follow the US news feeds. At this time, the lion's share of all news that excites the markets and makes them trade actively comes from America. Recent key topics are coronavirus, vaccinations and elections. If the number of daily reported cases in the US continues to decline, that's good for the dollar. If the US starts the vaccination procedure, it is also good for the dollar. Elections are simply an undying topic on which the future of the country and its foreign and domestic policies depend.

Possible scenarios for September 8:

1) Buy positions on the pair are generally not recommended at this time, since the pair has settled below the upward trend line, so it is more on the downtrend. Nevertheless, if the price rebounds off the lower line of the small side channel at 1.1790, then novice traders can try to take longs with the target of the upper line of the same channel at 1.1865. The problem is that it needs a clear rebound at 1.1790, which is not yet available.

2) Sell positions are still looking more relevant now. However, the price fell to the lower line of the side channel, so you are advised to not sell the pair at this time. In order to be able to open new short positions, you are advised to wait until quotes settle below the side channel and in this case, start new sell positions while aiming for 1.1766 and 1.1700. However, volatility at this time remains weak, you can also consider it as very weak, and with such volatility, the price will unlikely be able to reach 1.1700 today or tomorrow, even theoretically.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment