Yesterday, the Australian dollar paired with the US currency experienced one of the most unfortunate days in recent times, losing almost 100 points in a day. Marking a high of 0.7311, the Aussie ended Tuesday's trading session at 0.7212. This is the strongest intraday decline rate in the last three months. The southern dynamics of AUD/USD was primarily due to the strengthening of the US currency. But the Australian dollar also fell in price across the market due to another escalation of the political conflict between Australia and China. At the moment, the pair is frozen at the base of the 72nd figure, although from a technical point of view, the southern impulse has a "power reserve" for another hundred points down, that is, to the level of 0.7110. Whether the AUD/USD bears will take advantage of this opportunity is an open question.

By and large, the US dollar has been demonstrating multidirectional dynamics lately. Since the beginning of August, the dollar index has fluctuated in a wide range - it alternately decreases to the base of the 92nd figure, then rises to the borders of the 94th level. The current growth is associated with the beginning of the political season in the States - the Congressmen of the Senate and House of Representatives returned from the summer holidays.

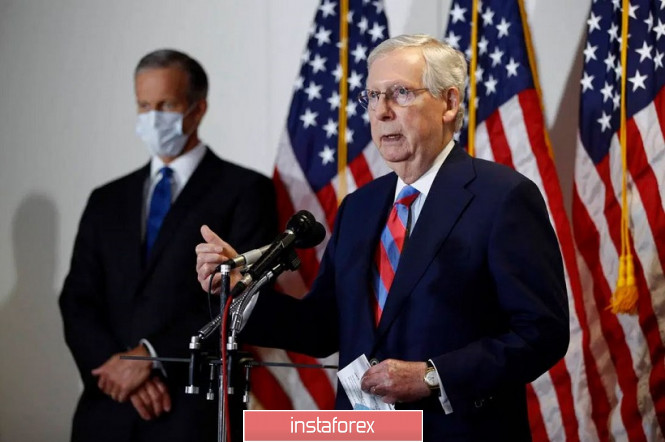

Last day, it became known that the senators will finally consider the next version of the bill on providing additional assistance to the US economy this coming Thursday, that is tomorrow. This was reported not by anyone, but by the leader of the Republican majority in the Senate, Mitch McConnell. Let me remind you that such bills have been under discussion since mid-July. Democrats and Republicans could not come to a common opinion after weeks of negotiations - each remained unconvinced. The Representatives of the Democratic party insist on increasing the amount of aid "at least" to two trillion dollars (previously it was about three trillion), while the White house and most Republicans insist on their own version, which currently involves the allocation of 500 billion. Negotiations reached an impasse in mid-August, so the current optimism of dollar bulls does not quite match the real picture. It is noteworthy that the previous bill of the Trump administration assumed the allocation of 1 trillion - according to the updated version of the document, Republicans propose to allocate half as much to fight the casualties of COVID-19 pandemic.

This version of the bill is not supported by some Republicans, not to mention the representatives of Democrats. According to American experts, the proposed document will not pass even the stage of procedural voting in the upper house of Congress. This is confirmed by the position of prominent congressmen. So, the leader of the Senate minority Charles Schumer and the speaker of the House of representatives Nancy Pelosi (the lower house of Congress is controlled by Democrats) have already declared that the Republican bill "is a failure in advance and unpromising." In addition, according to various estimates, about two dozen senators from the Republican party also do not support the allocation of any additional funds to combat the consequences of the coronavirus crisis. Actually, the leader of the Senate Republican majority, Mitch McConnell, could not answer the question of journalists - whether there are the necessary votes for the proposed bill. Given this disposition, it can be assumed that the above-mentioned draft law will either be removed from the vote, or it will be defeated this Thursday, that is, tomorrow.

The optimism of dollar bulls looks premature, to put it mildly. And as soon as experts' assumptions about the bill's prospects become reality, all the market's attention will be focused on Friday's inflation release. At the same time, it is worth recalling that even preliminary forecasts do not promise us inflation anything good - according to experts, the consumer price index will show negative dynamics, both on an annual and monthly basis.

Meanwhile, the Australian dollar is under background pressure from another fundamental factor. As you know, the political conflict between Australia and China has not yet been resolved, and its manifestations are very diverse. For example, at the end of last week, Beijing imposed new restrictions on imports of agricultural products. To be more precise, China suspended deliveries of agricultural products from Western Australia, saying that "harmful weeds were found in the cargo." Representatives of the exporter - the Australian company CBH Grain Pty - said that this batch was no different from hundreds and thousands of others and meets all the requirements. However, the fact remains that China continues to show Australians its dissatisfaction with Canberra's policy regarding the "anti-China COVID-19 investigation." This factor exerts background pressure on the Aussie, especially during periods of escalating political conflict. But it is worth noting that those goods that have so far been subject to sanctions by Beijing represent a small part of the trade turnover, while goods that are strategically important for the Australian economy (iron ore, gas and coal) are not yet instruments of influence in the context of political confrontation.

In consequence, the Australian dollar paired with the US currency is likely to follow the greenback in the near future. In my opinion, short positions on the AUD/USD pair are currently unreliable, given the failed prospects of the Republican Bill. Therefore, at the base of the 72nd figure, we can consider long positions with the main goal of 0.7300 - this is the Conversion Line on the daily chart.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment