The US Federal Reserve left its key rate unchanged in the range of 0-0.25 following the September meeting. According to the statement, the rate will remain at the current level until the labor market reaches full employment and inflation rises to 2% or more.

Average forecasts for key parameters have been improved, and, as J. Powell later explained, "the economy has been recovering faster in the past two months than previously thought." The markets regarded the results of the statement as quite confident, and the dollar somewhat strengthened instead of the predicted decline.

At the same time, there are several factors that the Fed carefully avoids in its comments in order to prevent a very strong market reaction. The restrained reaction of the market can only be explained by one thing – complete disorientation. It was the first time in history that several factors gathered all at once, each of which only emphasizes the depth of the problem, and the fact that the period of low rates will drag on until 2023 is only a small and insignificant detail, since no one knows what factors will be decisive in 2023.

It was reported earlier that the US Federal budget deficit in 2020 will be approximately $ 3.3 trillion, or 16% of GDP, the highest since the Second World War. In a narrow sense, the US budget deficit has always been considered a secondary indicator, since foreign buyers instantly bought the government's debt issued.

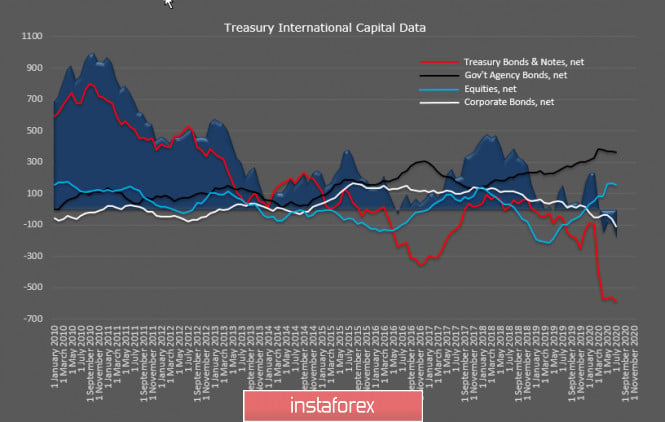

Now, here's the latest data. The Treasury released a report on foreign purchases of securities through July less than an hour after Powell finished his press conference. The total sales in a year rose from 90.4 billion to 185.1 billion, which is another anti-record, while Treasury Bonds & Notes, or government securities declined to -591 billion in a year.

So, the budget deficit is growing at a record, and foreign holders are getting rid of government securities simultaneously. Moreover, funding for the growing black hole is possible only at the expense of US domestic reserves.

This means that the Fed is unlikely to expand the asset repurchase program, and if the emphasis of the accompanying statement and the subsequent conference by J. Powell yesterday was on very low rates and their connection to the state of the labor market, then in fact we must assume that this focus was intended to calm the markets and give them at least some guidance, but in no way reflected the real level of problems facing the US monetary authorities.

It was expected that the dollar would fall if the results of the meeting are in line with forecasts. As the outlook for inflation, unemployment and GDP improved, the dollar rose and is likely to further rise in the near future. Moreover, we should also consider the fact that avoiding comments on the expansion of QE will contribute to a reversal of the stock market, but in reality, QE will continue, which will allow shares to grow further and at least will contribute to a rise in demand for the dollar.

EUR/USD

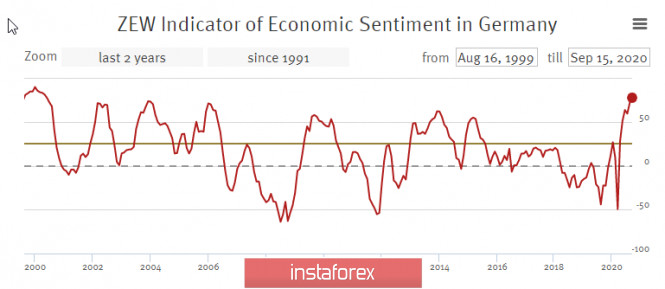

The ZEW economic sentiment indicator for Germany rose to 77.4p in September, which is the highest in 20 years.

The strong growth reflects investors' positive mood associated with the recent adoption of the EU's 750 billion euro stimulus package.

It's time for the euro to leave the range. The initial market reaction led to the euro's decline, so testing the support zone 1.1695/1710 looks more likely on Thursday morning. The dollar will grow evenly stronger as long as there is no information about the method of financing the US budget. Most likely, this will happen immediately after the election.

GBP/USD

The Bank of England traditionally follows the Fed's policy with a time lag of several months, so today's BoE meeting is unlikely to bring any changes. The high uncertainty associated with the high probability of the UK leaving the EU without a deal ties the hand of the Bank of England – it needs to understand how the economic and political situation will develop in order to make changes in monetary policy.

There are few reasons for the continuation of the pound's growth. Here, attempts to rise to the resistance zone 1.3005/35 will most likely be inactive. It is more likely to go below the trend line, that is, below 1.29 with the goal of retesting the low 1.2760.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment