Outlook on September 1:

Analytical overview of currency pairs on the H1 scale:

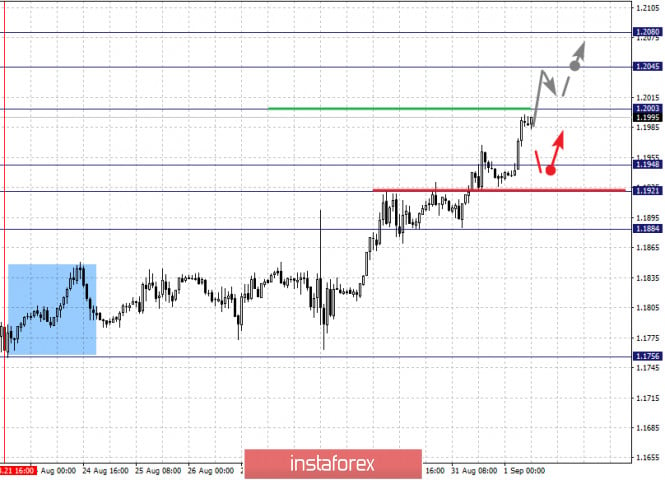

The key levels for the euro/dollar pair on the H1 chart are 1.2080, 1.2045, 1.2003, 1.1948, 1.1921 and 1.1884. We are following the development of the upward cycle from August 21. Here, the upward movement is expected to continue after the breakdown of 1.2003. In this case, the target is 1.2045. On the other hand, we consider the level of 1.2080 as a potential value for the top; Upon reaching which, we expect consolidation and a downward pullback.

A short-term downward movement is possible in the range of 1.1948 - 1.1921, breaking through the last value will lead to a deep correction. The target here is 1.1884, which is the key support level for the upward structure of August 21.

The main trend is the upward cycle of August 21

Trading recommendations:

Buy: 1.2003 Take profit: 1.2045

Buy: 1.2047 Take profit: 1.2078

Sell: 1.1948 Take profit: 1.1924

Sell: 1.1918 Take profit: 1.1886

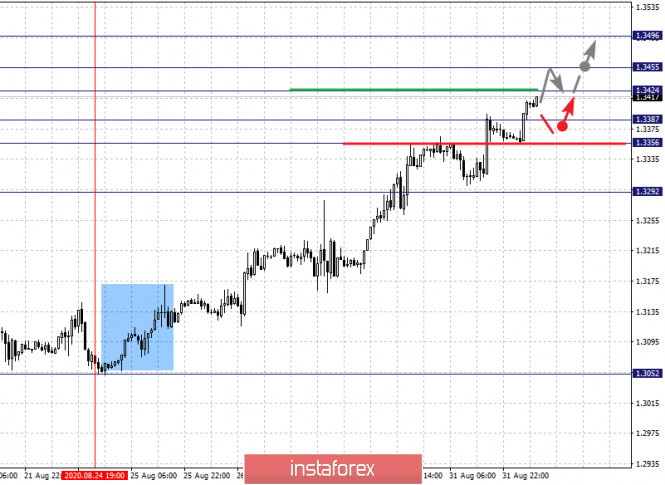

The key levels for the pound/dollar pair are 1.3496, 1.3455, 1.3424, 1.3387, 1.3356 and 1.3292. Here, we are following the development of the upward cycle from August 24. A short-term upward movement is expected in the range of 1.3424 - 1.3455. Now, if the last value breaks down, it will lead to a movement to a potential target - 1.3496. Upon reaching this level, we expect consolidation and a downward pullback.

A short-term downward movement is possible in the range of 1.3387 - 1.3356. Now, the breakdown of the last value will lead to a deep correction. The target is 1.3292, which is the key support level for the top.

The main trend is the upward cycle of August 24

Trading recommendations:

Buy: 1.3424 Take profit: 1.3455

Buy: 1.3457 Take profit: 1.3496

Sell: 1.3385 Take profit: 1.3356

Sell: 1.3354 Take profit: 1.3294

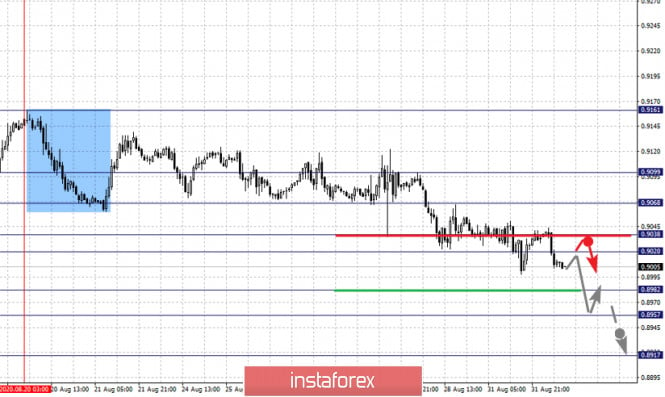

The key levels for the dollar/franc pair are 0.9099, 0.9068, 0.9038, 0.9020, 0.8982, 0.8957 and 0.8917. We are following the downtrend cycle from August 20. Here, a short-term downward movement is expected in the range of 0.8982 - 0.8957. If the last value breaks down, a strong movement to the potential target - 0.8917 should follow. Upon reaching this level, we expect an upward pullback.

A short-term upward movement is possible in the range of 0.9020 - 0.9038 and the breakdown of the last value will lead to a deep correction. Meanwhile, the potential target is 0.9068. We consider the level of 0.9099 to be a potential value for the top, from which we can expect the initial conditions for the upward cycle to form.

The main trend is the downward cycle from August 20.

Trading recommendations:

Buy : 0.9020 Take profit: 0.9037

Buy : 0.9040 Take profit: 0.9068

Sell: 0.8980 Take profit: 0.8958

Sell: 0.8955 Take profit: 0.8920

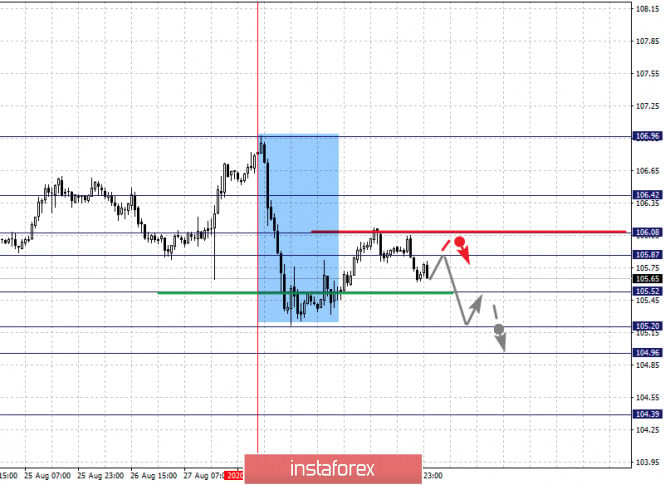

The key levels for the dollar/yen pair are 106.42, 106.08, 105.87, 105.52, 105.20, 104.96 and 104.39. Here, we are following the formation of the downward potential from August 28. We expect the downward movement to continue after the breakdown of 105.52. In this case, the target is 105.20. Meanwhile, price consolidation is in the range of 105.20 - 104.96. For the potential value for the bottom, we consider the level 104.39. A strong upward movement is expected after the breakdown of the level of 104.94.

A short-term upward movement is possible in the range of 105.87 - 106.08 and breaking through the last value will lead to a deep correction. Here, the target is 106.42, which is the key support for the downward structure from August 28.

The main trend is the formation of the downward potential from August 28

Trading recommendations:

Buy: 105.87 Take profit: 106.08

Buy : 106.10 Take profit: 106.40

Sell: 105.52 Take profit: 105.20

Sell: 104.95 Take profit: 104.40

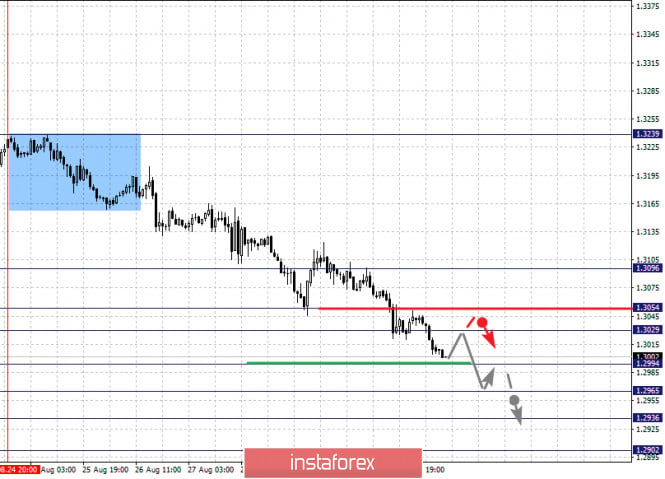

The key levels for the USD/CAD pair are 1.3096, 1.3054, 1.3029, 1.2994, 1.2965, 1.2936 and 1.2902. The development of the downward cycle from August 24 is being followed here. A short-term downward movement is expected in the range 1.2994 - 1.2965, breaking through the last value will lead to a movement to the level of 1.2936. On the other hand, we expect consolidation and a possible upward pullback near this level. For the potential value for the bottom, we consider the level of 1.2902, from which there is a reversal into correction.

A short-term upward movement is possible in the range of 1.3029 - 1.3054. If the last value breaks down, a deep correction may occur. Here, the target is 1.3096, which is the key support level for the downward cycle.

The main trend is the local descending structure of August 24

Trading recommendations:

Buy: 1.3029 Take profit: 1.3052

Buy : 1.3056 Take profit: 1.3096

Sell: 1.2992 Take profit: 1.2965

Sell: 1.2963 Take profit: 1.2938

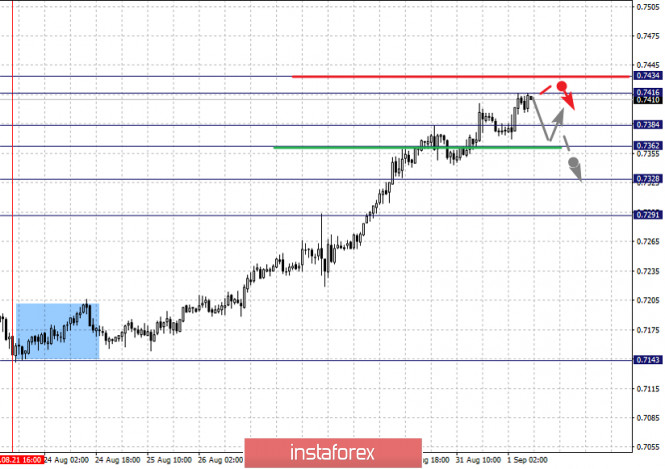

The key levels for the AUD/USD pair are 0.7434, 0.7416, 0.7384, 0.7362, 0.7328 and 0.7291. Here, we are following the upward cycle from August 21. At the moment, the price is near the limit values (0.7416 - 0.7434), from which a reversal into correction is expected. Meanwhile, a short-term downward movement is possible in the range of 0.7384 - 0.7362, a breakdown of the last value will lead to a deeper movement. The target here is 0.7328, which is the key support level for the top. The price passing through this will cancel the formation of initial conditions for a downward cycle. The potential target is 0.7291.

The main trend is the upward cycle of August 21

Trading recommendations:

Buy: Take profit:

Buy: Take profit:

Sell : 0.7418 Take profit : 0.7365

Sell: 0.7360 Take profit: 0.7330

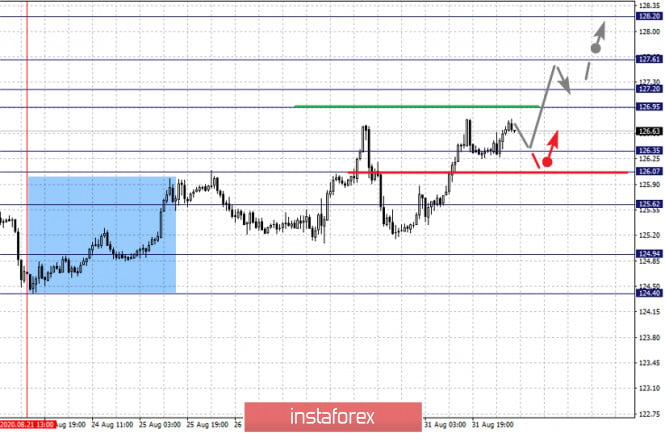

The key levels for the euro/yen pair are 128.20, 127.61, 127.20, 126.95, 126.35, 126.07, 125.62 and 124.94. We are following the medium-term upward structure from August 21st here. Now, the upward movement is expected to continue after the price passes the noise range 126.95 - 127.20. In this case, the target is 127.61. There is consolidation near this level. On the other hand, we consider the level 128.20 as a potential value for the top, from which we expect a downward pullback.

A short-term downward movement is expected in the range of 126.35 - 126.07. In case of breakdown of the last value, a deeper movement will occur. Here, the target is 125.62, which is the key support level for the top and its breakdown will be conducive to the development of a downward trend. In this case, the potential target is 124.94.

The main trend is the upward structure of August 21

Trading recommendations:

Buy: 127.20 Take profit: 127.60

Buy: 127.65 Take profit: 128.20

Sell: 126.35 Take profit: 126.08

Sell: 126.05 Take profit: 125.64

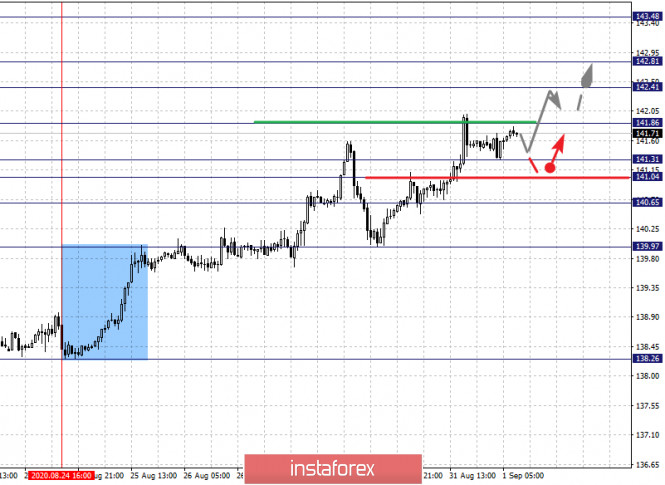

The key levels for the pound/yen pair are 143.48, 142.81, 142.41, 141.86, 141.31, 141.04 and 140.65. We are following the development of the upward structure from August 24. The upward movement will continue after breaking through 141.86. In this case, the target is 142.41. At the same time, there is a short-term upward movement and consolidation in the range of 142.41 - 142.81. We consider the level of 143.48 to be a potential value for the top. Upon reaching which, we expect a downward pullback.

A short-term downward movement is possible in the range of 141.31 - 141.04 and breaking through the last value will lead to a deep correction. The target here is 140.65, which is the key support level for the top.

The main trend is the upward structure from August 24

Trading recommendations:

Buy: 141.88 Take profit: 142.40

Buy: 142.42 Take profit: 142.80

Sell: 141.30 Take profit: 141.05

Sell: 141.02 Take profit: 140.65

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment