To open long positions in GBP/USD, you need:

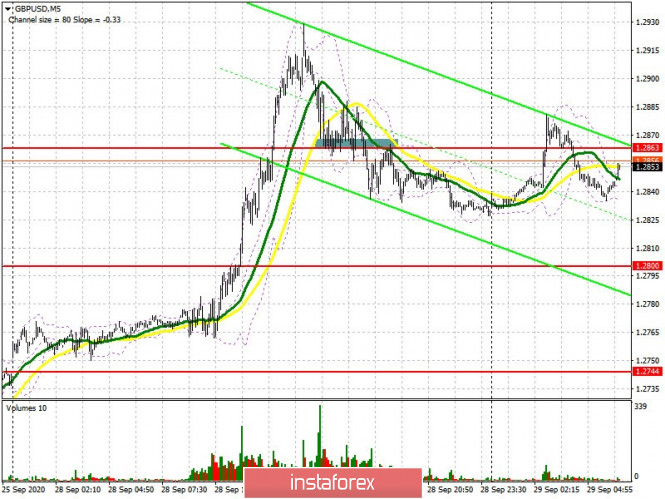

The pound sharply grew yesterday morning, due to rumors that the UK and the EU might reach a compromise on the trade deal, however, it was difficult to enter the market, since there were no convenient entry points. It was only possible to observe active development of the situation in the afternoon, at the 1.2863 level which we will now talk about. I recommended opening long positions from this level in the event of a decline and a false breakout there, which happened. On the 5-minute chart, we can see how the bulls defended support at 1.2863 with all their might, making several active attempts to resume the pound's growth, but they gave up and retreated from the market on the third test, thereby forming a new signal to sell the pound. A reverse test of the 1.2863 area is a good short entry point, bringing in about 40 points in profit.

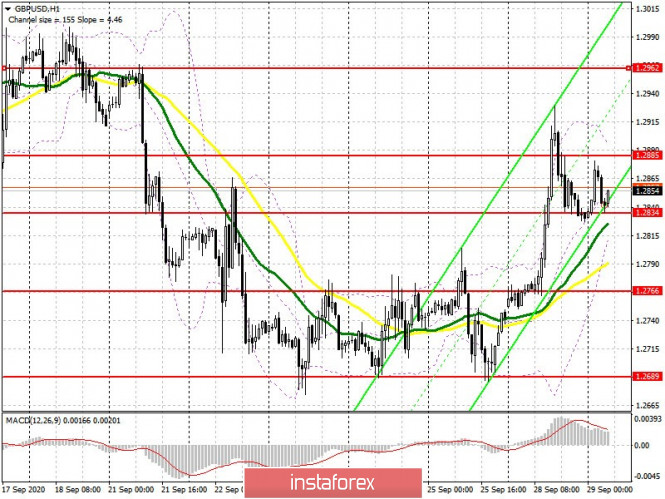

The situation has completely changed at the moment. Buyers will wait for a breakout and settle above the resistance of 1.2885, which will form a new signal to enter long positions with the main goal of updating a new high for this week in the 1.2962 area, which is where I recommend taking profits. The 1.3089 area will be a distant goal, and this is a very difficult target to achieve. In case the pound falls, forming a false breakout at the 1.2834 level will be a signal to open long positions. In case bulls are not active in this range, it is better to postpone longs until a larger low of 1.2766 has been updated, slightly above which the moving averages pass, playing on the side of the bulls. It is also possible to buy GBP/USD immediately on a rebound from the monthly low of 1.2689, counting on a correction of 30-40 points within the day.

The Commitment of Traders (COT) reports for September 22 did not record significant changes in the market, as everyone took a wait-and-see attitude and are watching how the economy will react to the next phase of growth in the incidence of COVID-19 and how the situation will develop further. Brexit. Most likely, the pressure on the pound will gradually return as the second wave of coronavirus spreads and the negotiations on a trade deal between the UK and the EU become more complicated, where there is not even a hint of a compromise between the parties. Short non-commercial positions slightly decreased from 41,508 to 40,523 during the reporting week. Long non-commercial positions also decreased from 43,801 to 43,487. As a result, the non-commercial net position remained practically unchanged at 2,964 against 2,293 weeks earlier.

To open short positions on GBP/USD, you need:

Sellers can quickly regain control of the market if yesterday's rumors and conversations are not reinforced. To do this, we need a breakout and have to settle below support at 1.2834. Testing this level on the reverse side forms a good entry point for short positions, which will quickly extinguish buyers' optimism and lead to an update of the first support level of 1.2766, which is where I recommend taking profits. The 1.2689 area will be a distant goal, testing it will mean the resumption of the bearish trend for the pound. If GBP/USD continues to grow, and this cannot be ruled out in the current conditions, then it is best not to rush to sell, but wait for a false breakout to appear in the resistance area of 1.2885. Selling the pair immediately on a rebound is only possible when the weekly high is updated in the 1.2962 area, counting on a correction of 30-40 points within the day.

Indicator signals:

Moving averages

Trading above 30 and 50 moving averages, which indicates the likelihood of a continuation of the upward correction for the pound.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A break of the lower border of the indicator in the 1.2810 area will lead to a new wave of decline for the pound. The breakout of the upper border in the 1.2890 area will lead to a new wave of growth for the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

Download NOW!

Download NOW!

No comments:

Post a Comment