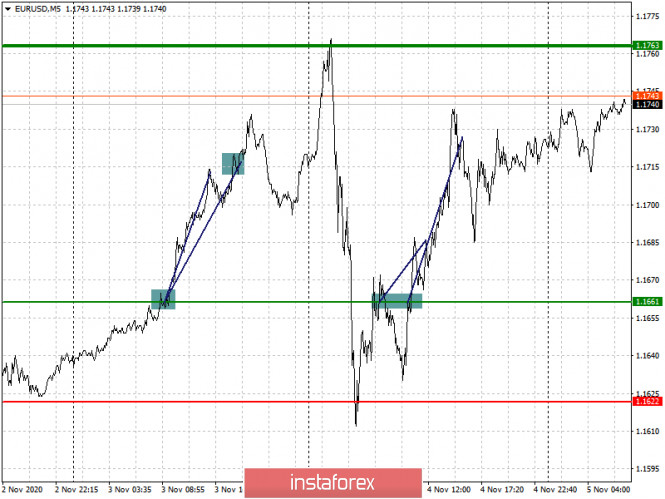

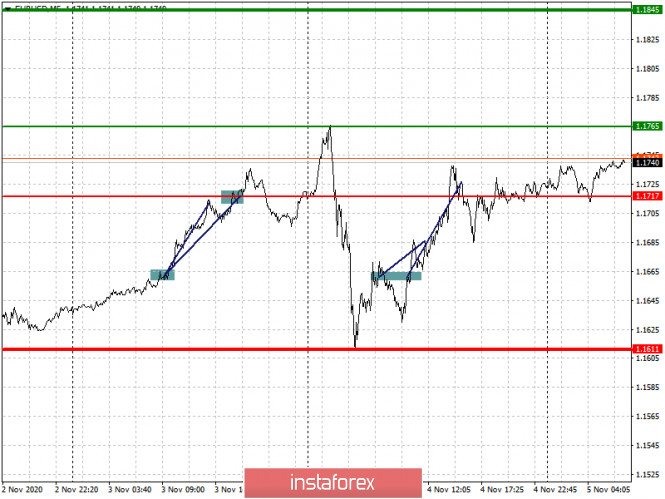

Analysis of transactions in the EUR / USD pair

At first, the euro dropped sharply amid Trump's lead over Biden in the US elections. Then, afterwards, the euro managed to get back its positions, thanks to the wave of long positions from the level of 1.1661, which brought about 50 pips of profit from the market. Biden's take over in the elections resumed growth immediately.

Trading recommendations for November 5

Of great importance is the results of the US presidential elections, as it will determine whether the US dollar will maintain its position in the market, or weaken against other currencies such as the euro. If Joe Biden wins, the US dollar will weaken sharply. In that case, long positions will be a more correct decision for trading.

Aside from that, the US Federal Reserve has a scheduled meeting today, however, many do not expect dramatic changes in the monetary policy. Nevertheless, the central bank's indecision will have a positive effect on the euro's position against the dollar.

- Open a long position when the euro reaches a quote of 1.1765 (green line on the chart), and then take profit at the level of 1.1845. However, growth will only occur if Joe Biden wins the US presidential elections.

- Open a short position when the euro reaches a quote of 1.1717 (red line on the chart, and then take profit around the level of 1.1611. However, a decline will only occur if Donald Trump wins the US presidential elections, as such will give the markets strong confidence in a stable future.

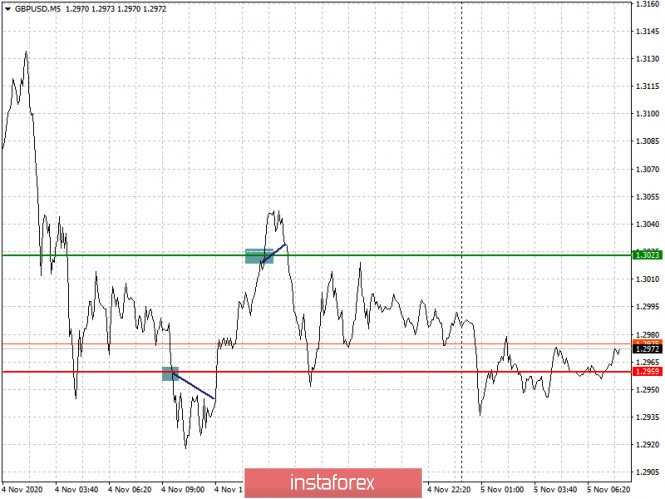

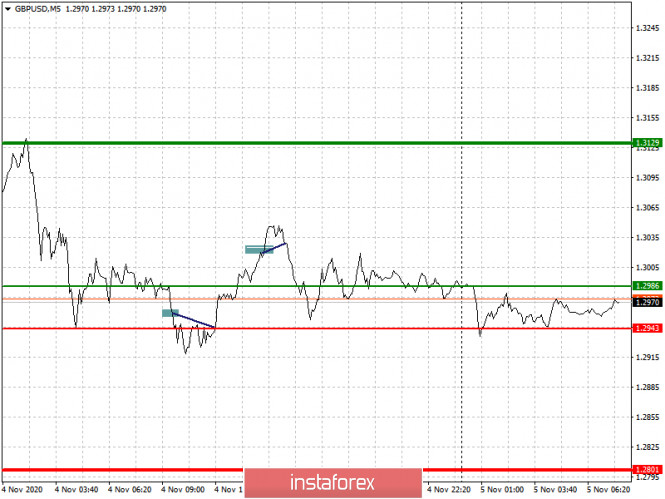

Analysis of transactions in the GBP / USD pair

Short positions from the level of 1.2959 moved the pound down by only 35 pips yesterday, after which it reversed and went back up in the market. The pressure was mainly generated by weak data on activity in the UK services sector, which continued to decline in October this year. Then, after the weakening of the US dollar amid Biden's lead in the US presidential elections, long positions arose around the level of 1.3023. However, the growth was limited by the Bank of England's scheduled meeting today.

Trading recommendations for November 5

Of great importance is the results of the US presidential elections, as it will determine whether the US dollar will maintain its position in the market, or weaken against other currencies such as the British pound. Aside from that, the meeting of the Bank of England today, at which the bank's asset purchase program may be expanded and key interest rates may be changed, will also affect the direction in which the GBP / USD pair will go in the market.

- Open a long position when the quote reaches the level of 1.2986 (green line on the chart), and then take profit around the level of 1.3129 (thicker green line on the chart). If the Bank of England does not expand its asset purchase program nor change its key interest rates, the pound will rise sharply in the market.

- Open a short position when the quote reaches the level of 1.2954 (red line on the chart), and then take profit at least at the level of 1.2801. Bad news on Brexit, as well as Trump's victory on the US presidential elections, will continue the downward trend in the GBP/USD pair.

Download NOW!

Download NOW!

No comments:

Post a Comment