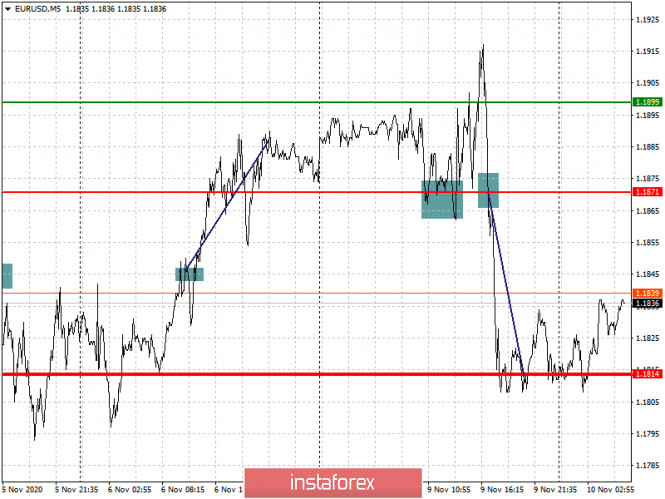

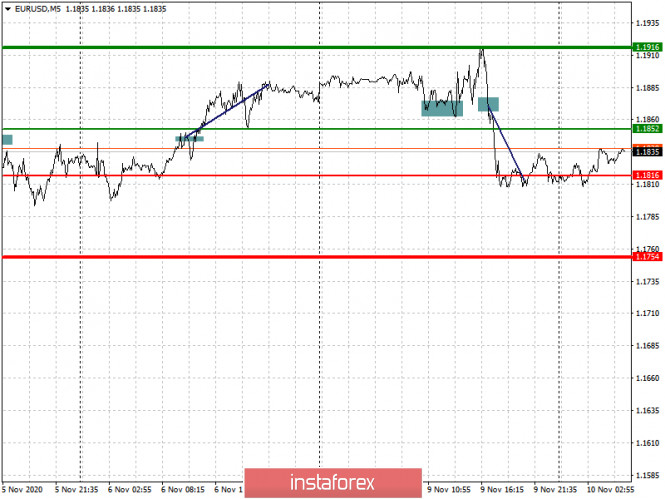

Analysis of transactions in the EUR / USD pair

The US announced that it successfully completed the third test of its coronavirus vaccine, so as a result, demand for the dollar rose rapidly in the market yesterday. To add to that, tensions over the US election were gradually decreasing, thus, demand for the euro amid expectations of Joe Biden's victory had shrunk as well. Short positions arose at the level of 1.1871, which brought the quote towards the target level of 1.1814. The downward movement to about 60 pips.

Trading recommendations for November 10

Contrary to what was expected, Joe Biden's victory did not result in a huge advantage for the bulls, and this is mainly due to the fact that many traders now see fears not in the political ambitions of Biden and the new stimulus package in the US, but in the problems of recovering the GDP of the eurozone and the services sector.

At the same time, the news that a vaccine for the coronavirus could be available early next summer raised the position of the dollar, thus, accordingly, the euro's position dropped back down in the market.

The upcoming data on Germany's business sentiment (for November) will also be published today, and if it indicates a serious deterioration in the index, it will be another reason for the decline of the European currency against the US dollar.

- Open a long position when the euro reaches a quote of 1.1852 (green line on the chart), and then take profit at the level of 1.1916. Growth will only occur if data on German business sentiment comes out better than the forecasts.

- Open a short position when the euro reaches a quote of 1.1816 (red line on the chart, and then take profit around the level of 1.1754. A downward correction is very much expected, after the strong bull market last week.

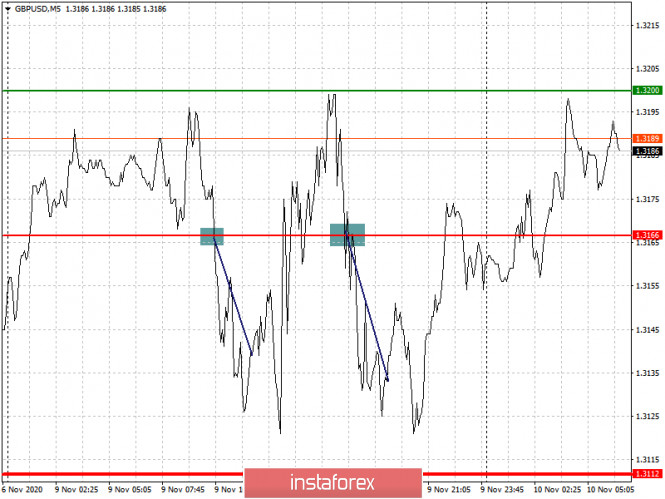

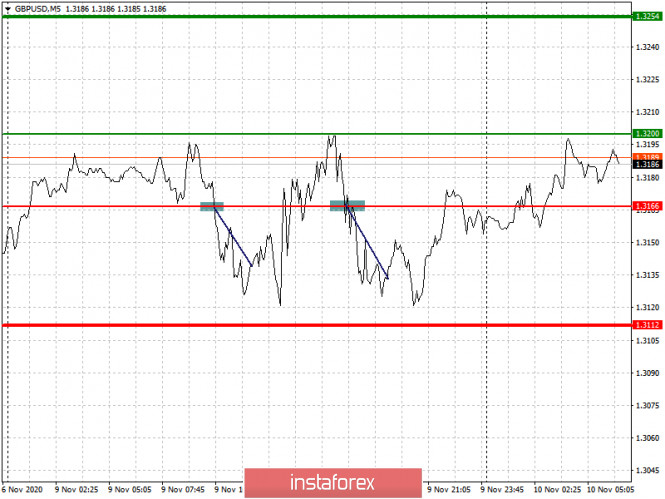

Analysis of transactions in the GBP / USD pair

Short positions arose at the level of 1.3166 yesterday. And although the movement down was not that large, the quote almost reached the target level, which is 1.3120.

Trading recommendations for November 10

Of great importance today is the upcoming data on the UK labor market, to which economists expect a 4.7% rise in unemployment, which will put pressure in the British pound. A weak labor market is harmful to the entire economy, especially in the face of another lockdown amid a second outbreak of the coronavirus pandemic.

- Open a long position when the quote reaches the level of 1.3200 (green line on the chart), and then take profit around the level of 1.3254 (thicker green line on the chart). Growth would occur if data on the UK labor market comes out better than the forecasts.

- Open a short position when the quote reaches the level of 1.3166 (red line on the chart), and then take profit at least at the level of 1.3112. Bad news on Brexit, as well as on UK unemployment, will return the downward trend in the GBP/USD pair.

Download NOW!

Download NOW!

No comments:

Post a Comment