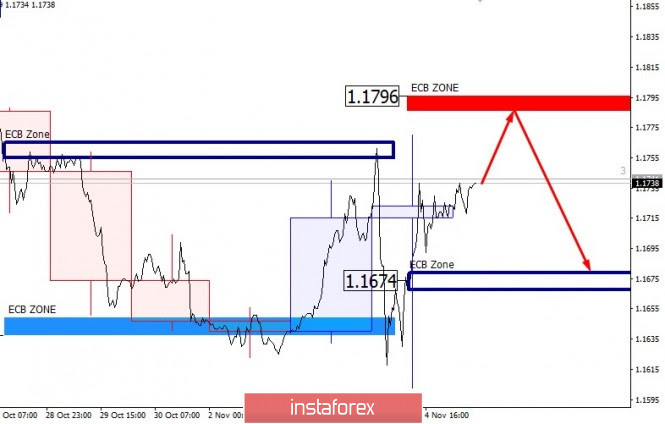

Yesterday's trading closed above the level of 1.1674. This indicates support for growth from the European Central Bank (ECB). The first growth target is the upper limit of the bank volatility zone of 1.1796. When this level is reached, you need to record most of the purchases. In the case of the pattern for sale, you can consider a short trade. The target of the decline will be the banking level of 1.1674.

Work in the range between the levels of 1.1796-1.1674 will be the main one until November 11. There is a possibility of a breakout and consolidation above the level of 1.1796 due to the fact that volatility in the currency market has increased. This was due to equalizing the size of the daily margin with the proactive one on the Chicago stock exchange. As soon as the values return to normal parameters, the volatility will return to its corridor. Working between banking zones involves using any entry patterns when testing support and resistance levels. Sales are profitable when testing the upper zone while purchases are profitable when testing the level of 1.1674.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment