To open long positions on EUR/USD, you need:

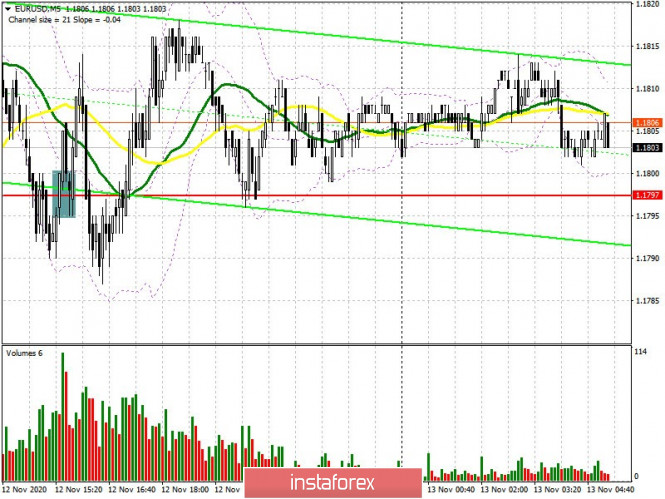

It seems that everyone is stuck at the 1.1797 level, which is where we have been all week. Taking one or the other, there is no effective direction for any of the parties. A signal to buy the euro appeared after being able to settle above the 1.1797 level yesterday afternoon, but it was "on the thin side", so those who were outside the market did not lose anything. If you look at the 5-minute chart, you will see that the bulls failed to keep the pair higher after initially returning to the 1.1797 level. An increase in long positions could be observed forming a false breakout in this range, but it had low profitability.

Nothing has changed from a technical point of view. Focus for the first half of the day will shift to important data on the European economy, since it may return the pressure on the euro. If buyers of the euro still manage to protect support at 1.1797, then forming the next false breakout there will be a good entry point into long positions, in hopes of moving to the resistance area of 1.1860, where I recommend taking profit. The next goal is the weekly high at 1.1915. If bulls are not that active, and the data turns out to be much worse than economists' forecasts, then it is possible for EUR/USD to return to the area below 1.1797. In this case, buyers will focus on protecting support at 1.1743 for the first half of the day. However, it is possible to open long positions from it on its initial test, counting on a correction of 15-20 points within the day. A larger reversal in favor of buyers will occur if they manage to form a false breakout at 1.1743.

To open short positions on EUR/USD, you need:

Sellers should return the 1.1797 level to themselves, which they missed yesterday morning and they also failed to do so after the release of weak fundamental statistics on US inflation. Getting the pair to settle below 1.1797 and testing it from the bottom up forms a more convenient entry point in order to sustain the downward trend. In this case, the nearest target of the bears will be the low of 1.1743. Testing this level will indicate the emergence of a new bear market for EUR/USD. However, only a breakout of this area can increase the pressure on the pair and will quickly pull it down to the 1.1701 low, where I recommend taking profits. If the bulls turn out to be stronger and continue to push the pair up after the release of data on the eurozone GDP and the unemployment rate, then it is best not to rush to sell, but instead you should wait until a larger resistance at 1.1860 has been updated. I recommend selling EUR/USD immediately on a rebound from a high of 1.1915 counting on a correction of 15-20 points within the day.

The Commitment of Traders (COT) report for November 3 recorded a reduction in long positions and an increase in short positions. Despite this, buyers of risky assets believe in the continuation of the bull market, although they prefer to proceed with caution. Thus, long non-commercial positions fell from 217,443 to 208,237, while short non-commercial positions rose from 61,888 to 67,888. The total non-commercial net position fell to 140,349, from 155,555 a week earlier. However, the bullish sentiment on the euro remains rather high in the medium term, especially after the victory of Joe Biden, who intends to endow the US economy with the next largest monetary aid package worth more than $2 trillion.

Indicator signals:

Moving averages

Trading is carried out just above 30 and 50 moving averages, which indicates the likelihood of the euro's succeeding growth.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Volatility has decreased, which does not provide signals to enter the market based on this indicator.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

Download NOW!

Download NOW!

No comments:

Post a Comment