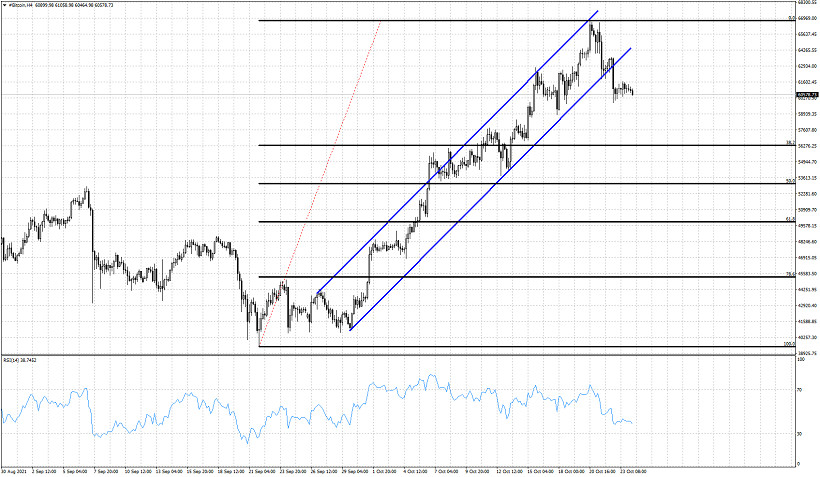

Bitcoin as expected from our previous analysis has broken the bullish short-term channel and is now challenging the $60,000 support level. Despite making a new all time high above $65,000, the RSI provided a bearish divergence and we noted that bulls needed to be cautious as a pull back was justified.

Black lines- Fibonacci retracement levels

Bitcoin is vulnerable to a move lower towards the 38% Fibonacci retracement. Having broken the bullish channel it was in has provided us with a bearish signal. This does not mean that the recent high is a major top. However in the near term price is vulnerable to the downside. A pull back towards $55,000 or even $50,000 is justified in order for bulls to gather momentum by creating a higher low before the next attempt to break above $65,000.

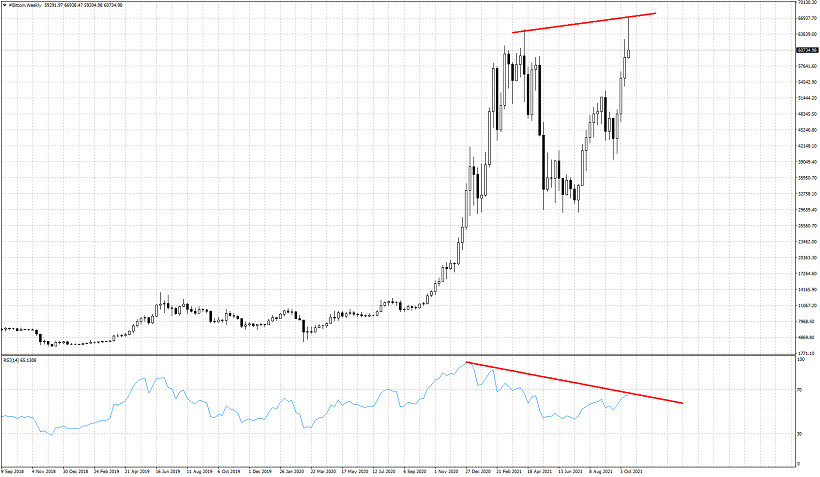

On a weekly basis price is forming a reversal candlestick pattern and the RSI is providing a bearish divergence. Although both are not sell signals, they provide a major warning of what could come. Bulls need to be cautious and patient. The closer the weekly close will be to $49,500, the more bearish the candlestick will be. Bulls do not want to see a long upper shadow in the daily candlestick.

The material has been provided by InstaForex Company - www.instaforex.comfrom RobotFX

Download NOW!

Download NOW!

No comments:

Post a Comment