To open long positions on EUR/USD, you need:

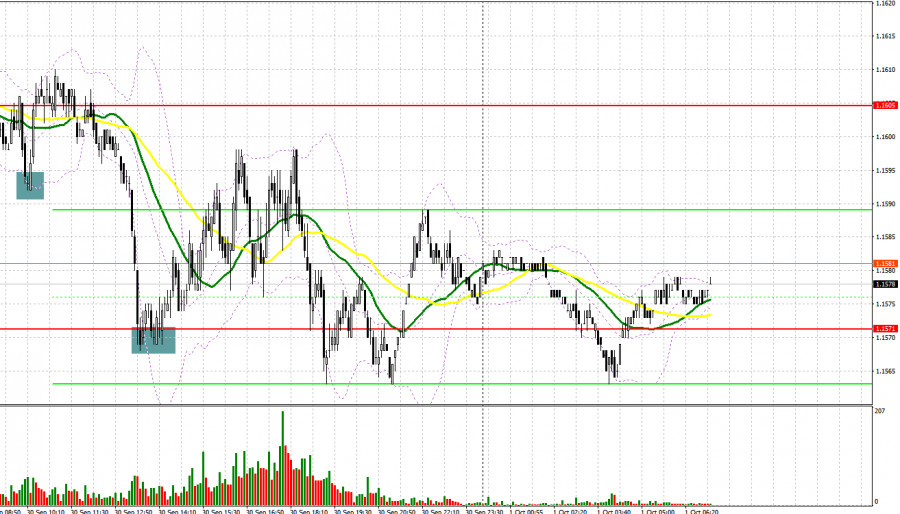

As yesterday, the euro bulls did not try to resist under the pressure of the bears, but nothing good came of it. However, several signals to enter the market were still generated. Let's take a look at the 5 minute chart and understand the entry points. A decline and a false breakout in the 1.1592 area, which I drew attention to in my morning forecast, resulted in forming a signal to buy the euro in hopes of a recovery to a high like 1.1619. However, we did not reach it and somewhere around 1.1610 the pressure on the euro returned. Then there was a breakthrough of 1.1592. It was without a reverse test from the bottom up this level, so I had to miss the downward movement to the support of 1.1571. In the second half of the day, bulls managed to defend the level of 1.1571, creating a false breakout there and a good signal to buy the euro, which caused the pair to recover by more than 30 points within the day.

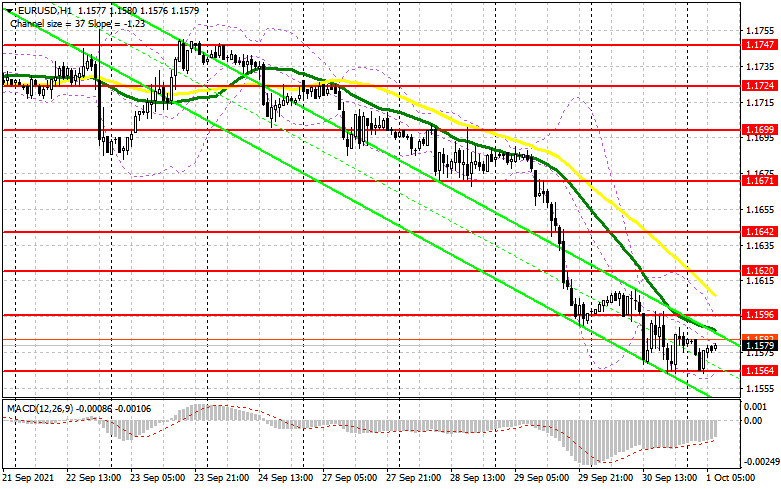

Today we are waiting for a fairly large series of fundamental statistics on the euro area, which will once again prove to the European Central Bank the need for changes in monetary policy, especially if inflation in the euro area turns out to be higher than economists' forecasts. You should also pay attention to the change in the volume of retail trade in Germany and the indexes of business activity in the manufacturing sector of the eurozone countries. The growth of indicators will have a positive effect on the prospects for the euro's upward correction in the first half of the day. An important task for the bulls during the European session is to protect the support at 1.1564, which was formed at the end of yesterday. A very strong upward correction can be built from this level today, so I advise you to pay special attention to it. Forming a false breakout there will result in creating a signal to open long positions in hopes of an upward correction to the resistance area of 1.1596, where the moving averages, playing on the side of the bears, pass. A breakthrough and test of this level from top to bottom, together with good data for the eurozone, forms a convenient entry point into long positions with the goal of restoring the pair to the 1.1620 area. The next target will be the area of 1.1642, where I recommend taking profits. If the bulls are not active at 1.1564, I advise you to postpone long positions to new lows around 1.1538 and 1.1510. Opening long positions immediately on a rebound is possible only at the new local support at 1.1482, counting on an upward correction of 15-20 points within the day.

To open short positions on EUR/USD, you need:

Although the bears try, they succeed less and less. A very important task in the first half of the day will be a breakthrough of the level 1.1564, which was formed at the end of yesterday. Only such a scenario will keep the pressure on the pair, and the 1.1564 update from the bottom up will create a new entry point for short positions with the goal of pulling down EUR/USD to the 1.1538 area. However, before selling, look at the MACD indicator and the divergence that forms on it, which will limit the pair's downside potential in the short term. Only a breakthrough of 1.1538 with a similar test from the bottom up will push EUR/USD even lower - to the 1.1510 area. The next target will be the 1.1482 low, where I recommend taking profits. A more optimal scenario for selling the euro will be an upward correction in the resistance area of 1.1596, which may occur if good fundamental statistics for the eurozone are released. Forming a false breakout there creates a good entry point for short positions. If the bears are not active at 1.1596, it is best to postpone selling until the test of the larger resistance at 1.1620, or open short positions immediately on a rebound, counting on a downward correction of 15-20 points from the new high of 1.1642.

The Commitment of Traders (COT) report for September 21 revealed a sharp increase in short positions and only a slight increase in long positions, which is due to the lack of desire among traders to bet on strengthening risky assets at the beginning of this fall. The prospect of changes in the monetary policy of the Federal Reserve in November this year maintains demand for the US dollar, as many investors expect the start of a reduction in the bond purchase program from the central bank. The fact that inflation in the United States of America is almost out of control by the Fed speaks of possible more aggressive actions by the end of the year, which could seriously affect the sentiment of traders and investors. This week there will be a fairly large number of speeches by both the Fed and Chairman Jerome Powell, which may shed light on how the central bank will act in any given situation. Considering that energy prices continue to fly up, which will certainly affect the producer and consumer price index, specifics from the Fed would certainly not interfere with the markets. The demand for risky assets will remain limited due to the high likelihood of another wave of the spread of the coronavirus, and its new strain Delta. All this will force the European Central Bank to continue to adhere to a wait-and-see attitude and maintain its stimulating policy at current levels, since there are no serious inflationary problems in the eurozone so far. The COT report indicated that long non-commercial positions rose only slightly - from 186,554 to 189,406, while short non-commercial positions jumped quite seriously - from 158,749 to 177,311. At the end of the week, the total non-commercial net position dropped from the level of 27,805 to the level of 12,095. The weekly closing price also dropped to 1.1726 from 1.1809.

Indicator signals:

Moving averages

Trading is carried out below 30 and 50 moving averages, which indicates a bear market.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the upper border of the indicator in the area of 1.1596 will lead to a new wave of euro growth. A breakout of the lower boundary at 1.1564 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

from RobotFX

Download NOW!

Download NOW!

No comments:

Post a Comment