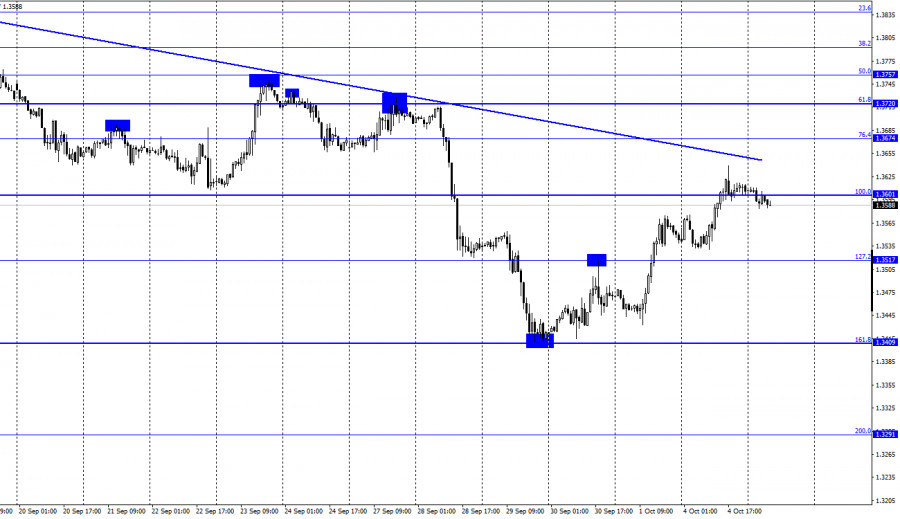

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair continued the growth process on Monday and even secured above the corrective level of 100.0% (1.3601). However, there was no rebound from the downward trend line, so traders were deprived of a strong sell signal. A little later, the quotes closed under the Fibo level of 100.0%, allowing us to count on a slight drop in the direction of the corrective level of 127.2% (1.3517). Fixing the pair's rate above the trend line will change the mood of traders to "bullish." There was also no single interesting report or speech in the UK yesterday. The pound continued to be in demand among traders, but I believe that this is a residual reaction to the fuel crisis in Britain. At first, traders massively sold out the pound when news appeared about the severe gasoline shortage at British gas stations. And now they are buying the pound because gasoline is starting to be delivered to gas stations, and the tension is easing. Everything is logical. Judging by the general trend, the fall of the British currency should now resume since bull traders failed to close above the trend line. In terms of information, traders can now only wait for Friday's reports on unemployment and the labor market in the United States. A report on business activity for the services sector will be released in Britain today. However, it is unlikely to be able to determine the mood of traders for the whole day. Thus, most likely, the Nonfarm Payrolls report will be the next global event that will be able to reverse the trend. Let me remind you that the state of the labor market depends on when the Fed will announce the beginning of the rejection of economic stimulus measures. If Nonfarm turns out to be weaker than forecasts for the second month in a row, this may further delay the moment of the Fed's rejection of the QE program. And it will be very difficult for the US dollar to continue growing with such an information background.

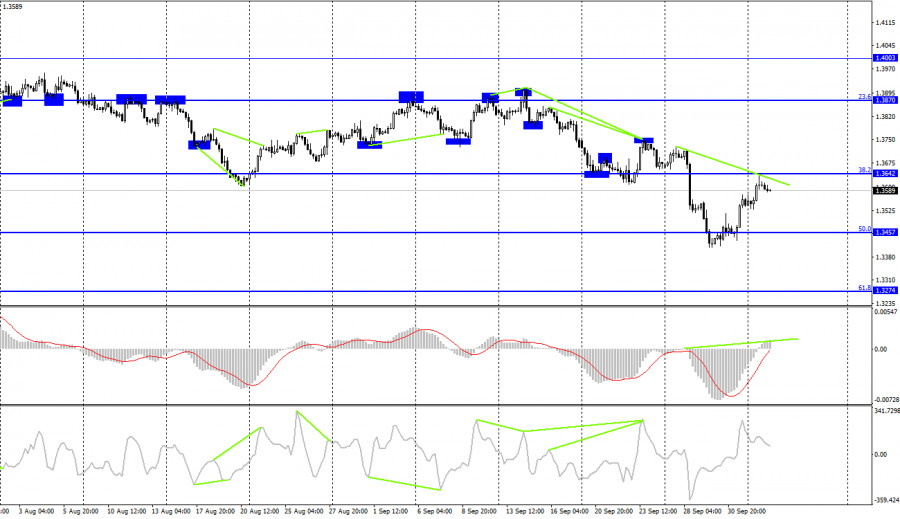

GBP/USD – 4H.

The GBP/USD pair on the 4-hour chart performed an increase to the corrective level of 38.2% (1.3642), rebound from it, and a reversal in favor of the US currency. Also, a bearish divergence has not yet formed. However, the MACD indicator has already matured, which increases the probability of a downward reversal and a new drop in quotes in the direction of the corrective level of 50.0% (1.3457). Closing the pair's rate above the level of 1.3642 will work in favor of continuing growth towards the next corrective level of 23.6% (1.3870).

News calendar for the USA and the UK:

UK - PMI index for the service sector (08:30 UTC).

US - foreign trade balance (12:30 UTC).

US - ISM index of business activity in the service sector (14:00 UTC).

On Tuesday, the calendars of economic events in the US and the UK contain just one important report for two. The ISM index for the service sector can attract traders' attention, but all other reports are unlikely. The information background will be medium-weak today.

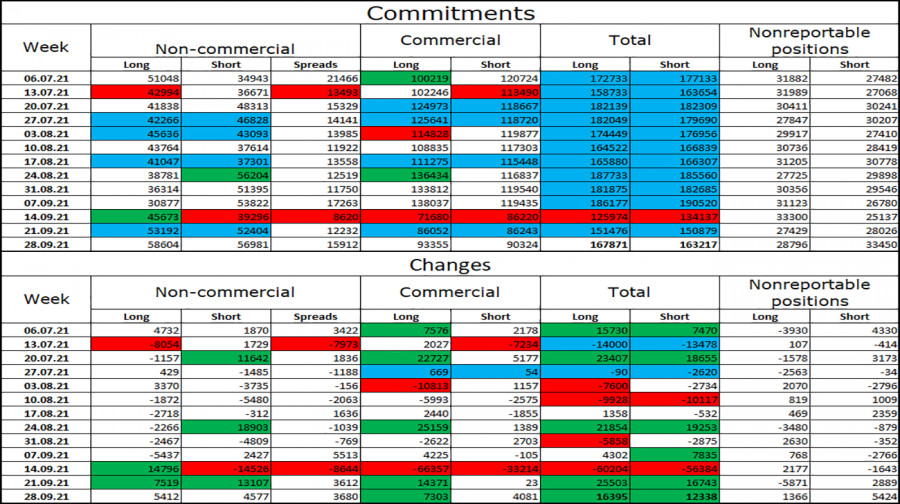

COT (Commitments of Traders) report:

The latest COT report from September 28 on the pound showed that the mood of the major players has become a little more "bullish." In the reporting week, speculators opened 5,412 long contracts and 4,577 short contracts. So the difference is not too big. In general, there is almost complete equality in the number of open long and short contracts for all categories of traders. It means that the mood of speculators is now as neutral as possible. Nevertheless, in recent months, the mood of the "non-commercial" category has only become more "bearish," so there is a trend that suggests a further decline in the British dollar.

GBP/USD forecast and recommendations to traders:

I recommend buying the pound when closing quotes above the level of 1.3642 on the 4-hour chart with a target of 1.3720. I recommend opening new sales now, as the quotes have rebounded from the level of 1.3642 on the 4-hour chart, with a target of 1.3517.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.comfrom RobotFX

Download NOW!

Download NOW!

No comments:

Post a Comment