USD/JPY

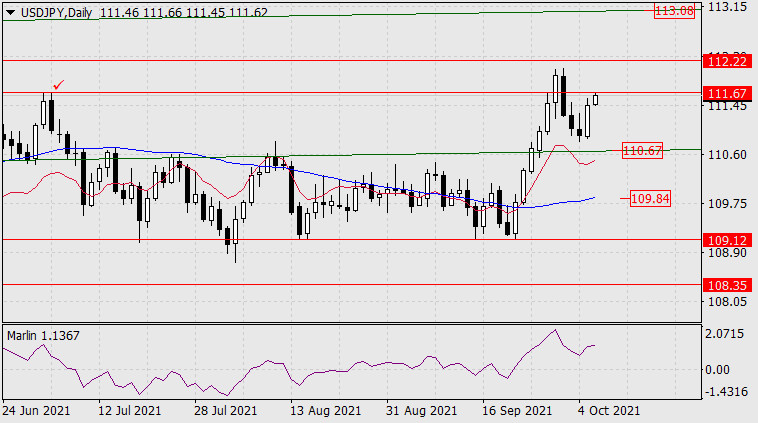

Yesterday's growth of the US stock market by 1.05% (S&P 500) was a good boost for the correctional growth of the USD/JPY pair by 53 points. This morning the price reached the target level of 111.67 (high on July 2) and there is a risk of a downward reversal from it to the support of the price channel line at 110.67. Consolidating above 111.67 opens the bullish target at 112.22, and breaking through 112.22 opens the target at 113.08 - the next line of the price channel on the higher-scale chart.

The main factor of developing the downward scenario, which we consider to be the main one, is the continuing deterioration of the situation in the stock markets. Yesterday's growth of the indices is still within the correction.

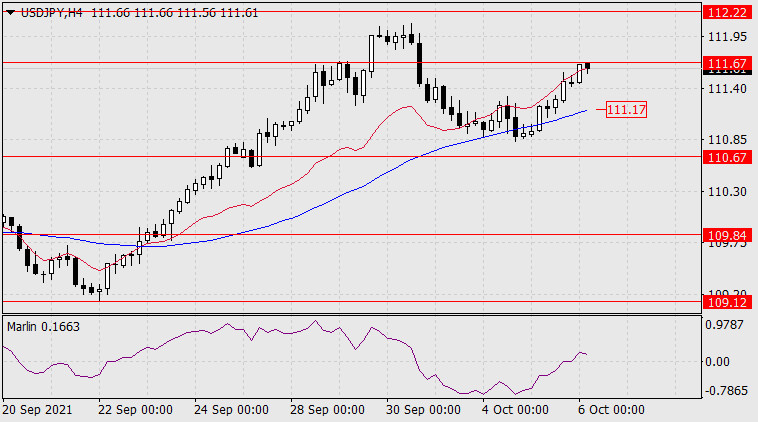

The situation is ascending on the four-hour chart, but the Marlin Oscillator only slightly entered the positive area, at any moment it is ready to return back below the zero line. When the price moves under the MACD line (111.17), the first bearish target at 110.67 is opened.

The material has been provided by InstaForex Company - www.instaforex.comfrom RobotFX

Download NOW!

Download NOW!

No comments:

Post a Comment