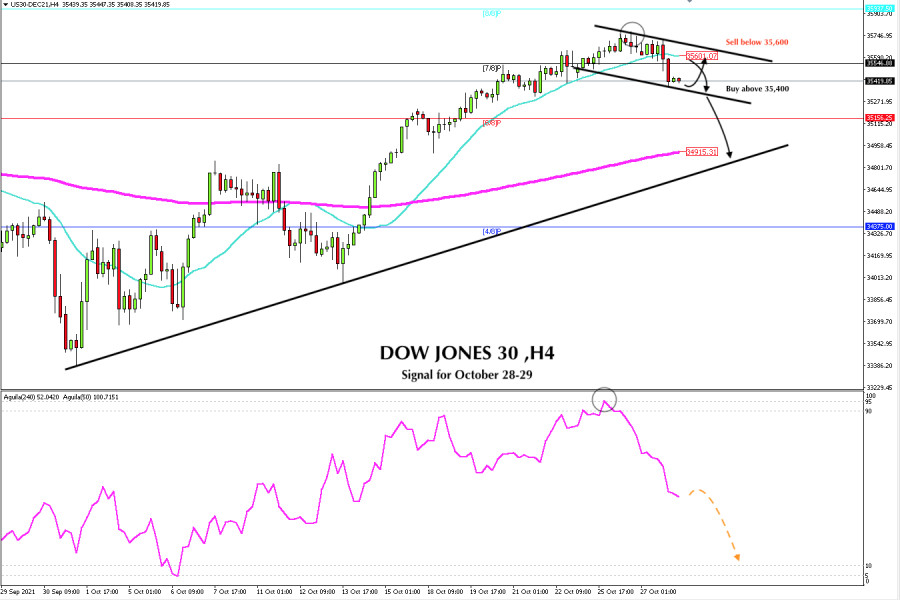

The Dow Jones 30 Technology Index (#INDU) hit a historic high of 35,775 on October 26. Now it is trading at 35,427 that is below the 21 moving average and below the 7/8 of murray. A correction is likely to continue to the 6/8 murray and up to the 200 EMA.

The Dow Jones started a new bullish wave from October 13 to October 26, having surged more than 1,700 pips. According to the technical indicators, the index is showing an overbought signal, and we can expect a correction to 50% of the Fibonacci retracement. This level is located at the psychological level of 35,000.

The main trend of the Dow Jones remains on the bullish side according to the daily chart. A break and consolidation above the all-time high of 35,775 will indicate a resumption of the uptrend.

On the other hand, a bearish move through 33,884 will change the main trend to the downside. This is the least probable scenario. If the price consolidates below the 200 EMA, it will signify the start of a new bearish scenario and we can expect a strong sell-off towards 34,375 (4/8).

If the downward correction continues and the index trades below the 21 SMA, there is a probability that it will fall to 35,156 (6/8). This will be an important support level. An upward rebound could happen, giving us an opportunity to buy.

Above the 200 EMA, a good technical rebound may occur because the overall trend is bullish. This area is considered a key level and a pivot point. Around this moving average, it will be a good strategy to buy with targets at 35,200 and up to 35,546 (7/8).

Our short-term strategy is to sell below 35,601 with targets at 35,156 and up to 34,915. The last 4-hour candles confirm the bearish reversal. Besides, having touched the level of 95, the eagle indicator is showing a downward signal.

Support and Resistance Levels for October 28 - 29, 2021

Resistance (3) 35,624

Resistance (2) 35,546

Resistance (1) 35,502

----------------------------

Support (1) 35,357

Support (2) 35,294

Support (3) 35,156

***********************************************************

A trading tip for DOW JONES 30 for October 28 - 29, 2021

Sell below 35,600 (SMA 21) with take profit at 35,400 and 35,156 (6/8), stop loss above 35,700.

The material has been provided by InstaForex Company - www.instaforex.comfrom RobotFX

Download NOW!

Download NOW!

No comments:

Post a Comment