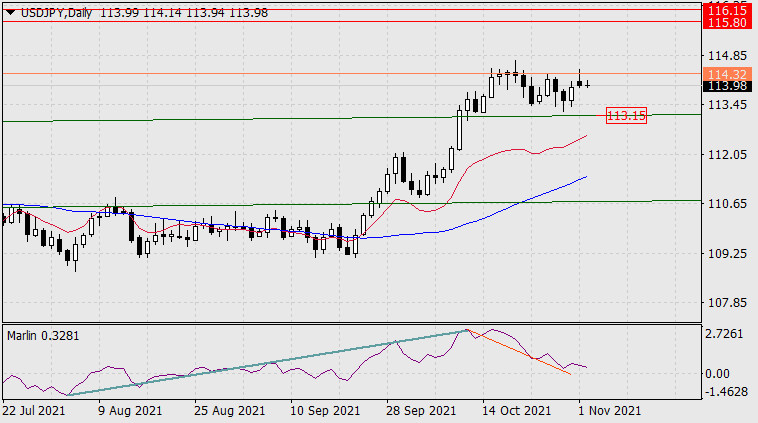

The USD/JPY pair's growth target is the 115.80-116.15 range. The USD/JPY pair grew by 5 points on Monday, breaking the signal level of 114.32 with the upper shadow of the daily candle.

It may seem that in case of a failed price transition above the signal level with a decreasing Marlin Oscillator, the price will continue to fall, but here another reading of the oscillator is connected: its decline, marked with a red line, is a correction from the growth marked with a thick azure line. Marlin has not yet left the territory of the positive trend, with a high degree of probability the oscillator may turn upwards from the current levels. Also, the 114.32 signal level can be determined by mistake, because yesterday the price reversed from earlier levels - from the peaks on October 15 and 18. To break the upward trend, the price needs to do a very strong thing - to overcome the support of the embedded line of the price channel of the higher timeframe near the price of 113.15.

The price convergence with the oscillator continues to develop on the four-hour chart. Under favorable circumstances, the Marlin reversal from the forming support can occur from the current levels. It will become an assertive growth after the price has overcome yesterday's high of 114.46. The growth target is the 115.80-116.15 range. The benchmark for this target is the August 2015 low and the January 2015 low.

The material has been provided by InstaForex Company - www.instaforex.comfrom RobotFX

Download NOW!

Download NOW!

No comments:

Post a Comment