- The bullish trend not only continues but also has great prospects

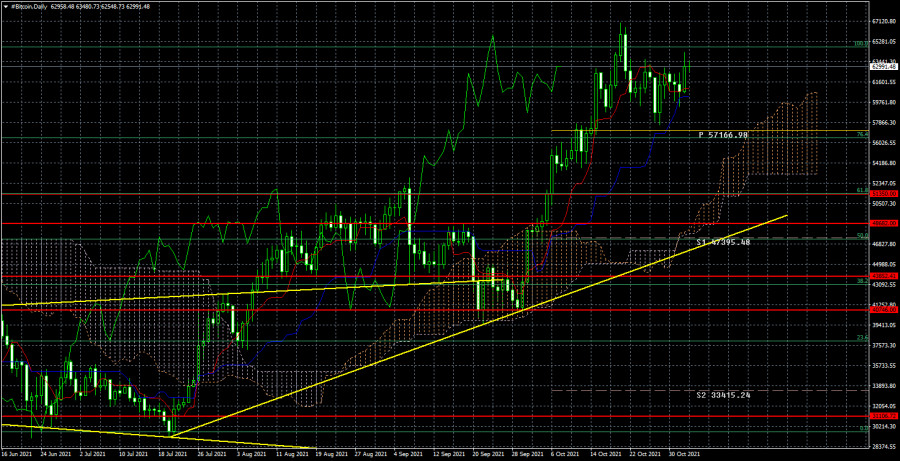

Yesterday, Bitcoin rose by $ 2,500. As a result, its quotes consolidated above the Ichimoku cloud in the four-hour timeframe, which indicates that the upward movement will most likely continue. The daily chart below clearly shows that the "bullish" trend continues and there is no reason to expect its end in the long term. In simple words, the price rebounded from the critical line a couple of days ago and can now return to its historical highs and update them. Thus, it remains only to continue to stay in purchases, and it will be possible to think about a downward movement no earlier than the consolidation of quotes below the critical line or the formation of a downward trend on the four-hour TF.

- Robert Kiyosaki criticizes the government for high inflation

Meanwhile, the author of the bestseller "Rich Dad, Poor Dad" Robert Kiyosaki made an extensive speech about a possible new economic crisis in the United States (and possibly around the world). According to Kiyosaki, the US authorities are contributing to the growth of inflation, not trying to reduce it, which will eventually hit the most low-income segments of the population while the rich will continue to get richer. "Joe Biden and the US Federal Government need inflation to prevent a new depression. And inflation makes the rich richer and the poor poorer. Biden and the feds are corrupt. Be prepared for an economic crisis and a new depression. Be reasonable. Buy gold, silver, and bitcoins," Kiyosaki said.

It can be recalled that this is not the first time when the States has predicted a new crisis and even an economic collapse, which will kill any economic growth for many years. Now, the problem is the huge national debt of the country, as well as the trillions of dollars that the Fed and the Federal Government have pumped into the economy and markets. In general, no one knows what will happen next, and how the economy will react to all this money in the future. The world has never faced such a large-scale crisis before. Therefore, anything can happen in the future, and the Fed and the Government need to turn on their forecasting abilities to prevent a new possible economic crisis.

- Bitcoin remains the best protection against inflation

At the same time, Bitcoin really remains one of the best means of protection against inflation. Although it is not the only one, it is one of the best. Thus, as long as inflation remains high and the QE program continues to function, this digital coin can continue to grow, as demand for it will constantly grow. In the event that the Fed announces the curtailment of the quantitative stimulus program today, then the BTC growth support factor will slowly begin to level off. But in any case, Bitcoin will maintain a favorable environment to further rise in the next 6-8 months.

The trend on the daily timeframe continues to be upward, and market participants were not able to consolidate below the critical line. Therefore, Bitcoin purchases with the targets of $64,700 and $67,000 currently remain more preferable. However, closing the price below the Kijun-sen line will open the way for the cryptocurrency to the lower border of the Ichimoku cloud, as well as the trend line. Anyhow, judging by the daily timeframe, the end of the upward trend will not be a threat to Bitcoin in the next few days.

The material has been provided by InstaForex Company - www.instaforex.comfrom RobotFX

Download NOW!

Download NOW!

No comments:

Post a Comment