Technical data:

Upper Linear Regression Channel - downtrend

Lower Linear Regression Channel - downtrend

Moving average (20-day period, smoothed) - sideways movement

The euro/dollar pair was traded coolly on Friday and Monday. So, they were calm days in the market. Friday saw the release of perhaps the most important macroeconomic data in the United States, and traders had a right to expect stronger movements. However, the reports turned out to be mixed. Nonfarm Payrolls came worse than expected. Meanwhile, unemployment and the ISM Services PMI beat economists' forecasts. In other words, the disappointing NFP report was offset by strong results in unemployment and business activity. In this light, markets did not know how to react. Anyway, Nonfarm Payrolls were the most important data published on Friday. The actual results came 2.5 times lower than the market had expected, which is a negative factor for the greenback. At the same time, it can be assumed that the jobs market is now giving way to inflation. Indeed, the unemployment report reveals that the jobs market is approaching its pre-pandemic levels. This means that Nonfarm Payrolls will continue to show modest growth. Consequently, the jobs market will no longer be the Federal Reserve's top priority as it is recovering well. Meanwhile, rising inflation starts to spook investors. In November, consumer prices are projected to accelerate to 6.7%-6.9% y/y. Therefore, the US Federal Reserve may well base its policy decision on inflation rather than on the state of the jobs market. The higher the inflation, the more likely the further monetary tightening. At this stage, tightening will be reflected in the acceleration of the winddown of the QE program. In other words, if inflation rises from a month before, the greenback will strengthen. Given that consumer prices are forecast to soar, markets may well start buying the dollar in advance.

Markets are unlikely to react to Christine Lagarde's speech

In terms of the technical picture, the quote has fallen to the moving average and is now traded slightly below it. The downtrend has resumed. As a result, the dollar is now rising against the euro. This week is not going to be eventful in terms of the macroeconomic calendar. The eurozone will present its ZEW Economic Sentiment Index, not the most important report, and the 3rd estimate of Q3 GDP (forecast: 2.2% q/q, in line with the 2nd estimate). ECB President Christine Lagarde will deliver a speech this week. The market is likely to show no reaction to her statements as she usually speaks 2-3 times a week and rarely says something investors have not already heard. Anyway, it is important to expect the pair to reverse sharply and volatility to increase when she speaks. However, it mostly never happens. The ECB's monetary policy meeting, the last one this year, will soon take place. Therefore, Lagarde is likely to once again repeat what she has already told: the economy is too weak, no rate hikes next year, as soon as the ECB's PEPP ends, the APP will be expanded. Therefore, is the Federal Reserve is likely to wind down the QE program by April, the ECB may well maintain it throughout 2022.

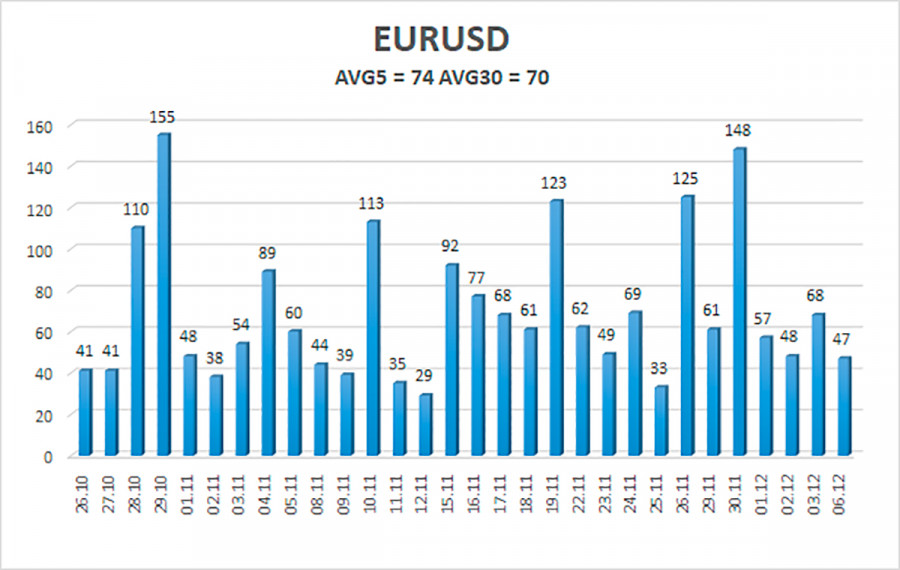

On December 7, EUR/USD volatility totals 74 pips. Today, the pair is expected to be in the range of 1.1207 and 1.1355. Heiken Ashi's reversal is likely to indicate a possible resumption of the uptrend.

Closest support levels

S1 – 1.1230

S2 – 1.1169

S3 – 1.1108

Closest resistance levels

R1 – 1.1292

R2 – 1.1353

R3 – 1.1414

Outlook:

EUR/USD consolidated below the MA. Short positions could be opened until the price consolidates above the MA with targets at 1.1230 and 1.1207. Long positions could be considered in case of consolidation above the MA with targets at 1.1353 and 1.1357.Chart description:

Linear Regression Channels help identify the current trend. If both channels move in the same direction, the trend is strong.

Moving Average (20-day, smoothed) defines the short-term and current trends.

Murray levels are target levels for trends and corrections.

Volatility levels (red lines) reflect a possible price channel the pair is likely to trade in within the day based on the current volatility indicators.

CCI indicator: when the indicator is in the oversold area (below 250) or in the overbought area (above 250), it means that a trend reversal is likely to occur soon.

The material has been provided by InstaForex Company - www.instaforex.comfrom RobotFX

Download NOW!

Download NOW!

No comments:

Post a Comment