To open long positions on GBP/USD, you need:

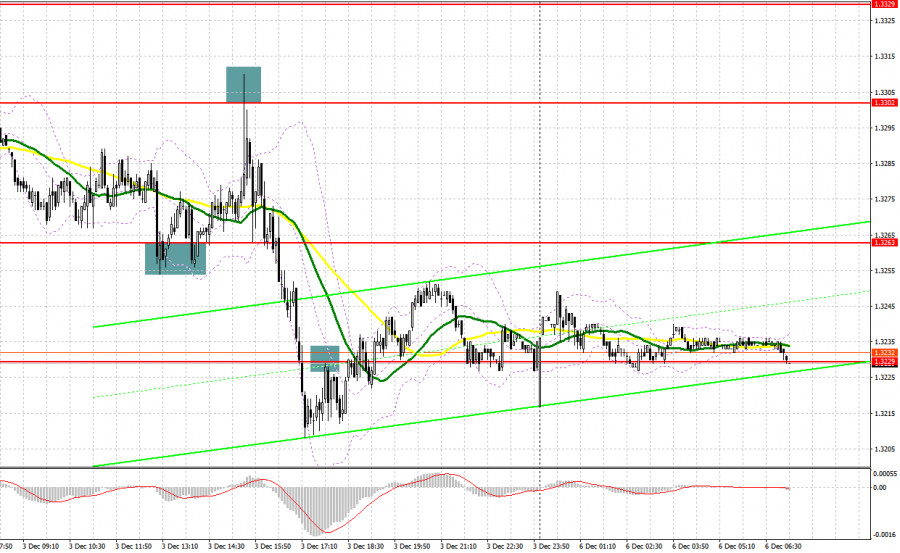

Several good signals to enter the market were formed on Friday. Let's take a look at the 5 minute chart and understand the entry points. The formation of a false breakout in the 1.3263 area in the first half of the day provided an excellent entry point for long positions, which led to a 40 points gain in the pound. After the release of the report on the US labor market, where a decline in the unemployment rate was recorded, the formation of a false breakout at 1.3302 resulted in forming a signal to sell the pound, and the breakthrough of 1.3263 only increased the pressure on the pair. Unfortunately, I didn't wait for the reverse test 1.3263 from bottom to top, so I didn't manage to add it to short positions. The breakthrough of both 1.3229 and the renewal of this level formed a signal to sell the pound further along the trend, but the bears preferred to take profits at the end of the week, which limited the pair's downward potential.

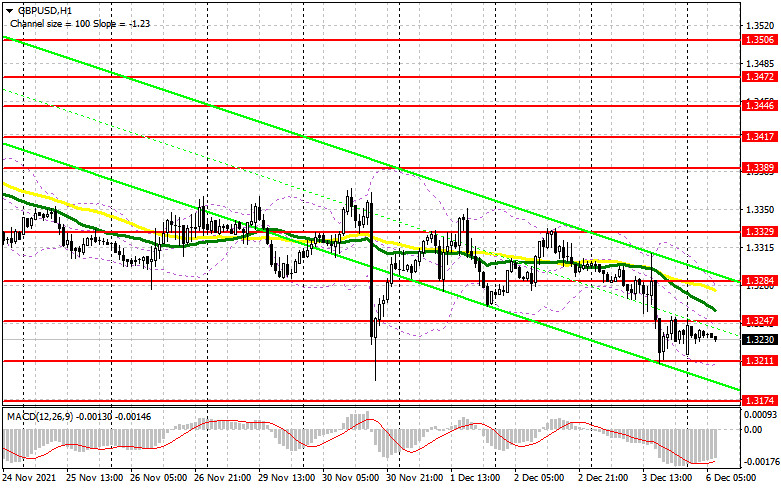

Today there are no important statistics for the UK and only the PMI for the construction sector will attract attention. It is unlikely that this report will seriously affect the market, but poor results could lead to a larger decline in GBP/USD. Bulls do not have much to count on at 1.3211, so a more important task in the first half of the day is to regain control over the resistance at 1.3247, above which the moving averages, playing on the side of the bears, pass. A downward test of this level, together with strong November UK construction data, can lead to a buy signal with the prospect of stopping the bearish momentum and GBP/USD retracement to 1.3284. A breakthrough of this range too will open a direct opportunity to renew the high at 1.3329, where I recommend taking profits. The next target is the resistance at 1.3389, but it will be quite difficult to reach it without good news. In case the pound falls during the European session, an important task is to protect the support at 1.3211. Only the formation of a false breakout there can result in creating a buy signal. I advise you to open long positions in GBP/USD immediately for a rebound but only from a low like 1.3174, or even lower - around 1.3139, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

It may be tough, but the bears manage to put pressure on the British pound, keeping it in a downward channel. To begin with, all that they now need is to protect the resistance at 1.3247, above which the moving averages pass. Forming a false breakout at this level along with weak data on the construction sector - will lead to the formation of a new entry point into short positions, followed by a decline to the area of the lower border of the horizontal channel at 1.3211, which is very important from a technical point of view. A breakthrough of this level will create real problems for bulls and keep the pair in a downward trend. A reverse test of 1.3211 from the bottom up will provide an excellent entry point, which will push GBP/USD to new lows: 1.3174 and 1.3139, where I recommend taking profits. The next target will be support at 1.3139, but we will fail to reach it if the situation in the UK worsens due to the number of infections with a new strain of coronavirus. In case the pair grows during the European session and the bears are weak at 1.3247, it is best to postpone selling until the larger resistance at 1.3284. I also recommend opening short positions there only in case of a false breakout. Selling GBP/USD immediately on a rebound is possible only from a large resistance at 1.3329, or even higher - from a new high in the 1.3389 area, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) reports for November 23 revealed that short positions increased and long positions decreased, which led to an even greater increase in the negative delta. The dovish statements of the Bank of England governor from last week kept the pressure on the British pound, even amid risks associated with higher inflationary pressures than previously expected. The aggravation of the situation with the coronavirus and the new Omicron strain in the European part of the continent did not add optimism. It is also not clear what is with the issue of the Ireland protocol, which the UK authorities are planning to suspend. At the same time, we are witnessing a rise in inflation in the United States of America and increased talk about the need for an earlier increase in interest rates next year, which is providing significant support to the US dollar. However, I recommend sticking to the strategy of buying the pair in case of very large falls, which will occur against the background of uncertainty in the central bank's policy. The COT report indicated that long non-commercial positions declined from 50,443 to 50,122, while short non-commercials rose from 82,042 to 84,701. This led to an increase in the negative non-commercial net position: delta was -34,579 against -31,599 a week earlier. The weekly closing price did not drop that much - from 1.3410 to 1.3397.

Indicator signals:

Trading is carried out below 30 and 50 moving averages, which indicates the formation of a downward trend in the pair.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper border of the indicator at 1.3275 will act as a resistance. A breakthrough of the lower border of the indicator in the area of 1.3211 will lead to another wave of the pound's fall.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

from RobotFX

Download NOW!

Download NOW!

No comments:

Post a Comment