The single European currency was doing nothing but growing throughout Wednesday. And all this happened against the background of a completely empty macroeconomic calendar. Some data were published only in the evening. Moreover, representatives of the European Central Bank hinted at the continuation of the stimulus measures. In particular, Isabelle Schnabel, during her speech, although she noted the negative impact of zero interest rates on the profits of the banking sector, reassured everyone that this negative is offset by the action of the quantitative easing program. And from her words, it can be concluded that the ECB still does not intend to take at least some steps towards tightening the parameters of monetary policy. However, she mentioned these things only in passing, without focusing on them. Whereas her speech itself was devoted to several other things. In particular, the fact that each of the member countries of the monetary union has different conditions, and each of them needs to make efforts in different directions from the others. And this, to some extent, is also a hint at maintaining the current parameters of monetary policy. So in general, the signals from the ECB were rather negative for the euro. Nevertheless, it grew steadily.

The British currency behaved somewhat strangely yesterday, as it had been doing nothing but getting cheaper all day. At the same time, the information background on the pound was virtually absent. No macroeconomic statistics, no statements by representatives of the Bank of England, no stupid sayings of the wisest politicians. In general, nothing. Even more surprising is the fact that the euro, which is somewhat in less comfortable conditions, has been doing nothing but growing. The pound revived only at the time of the publication of data on open vacancies in the United States. However, pretty soon the pound began to lose its position again. There is a feeling that investors simply do not believe in the pound, and they do not need any reasons to sell.

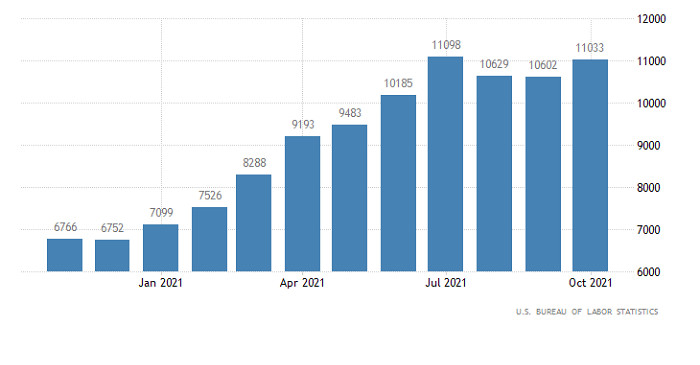

The US statistics, as noted earlier, caused a small surge, and the growth of the pound, as the increase in the number of open vacancies, from 10,602,000 to 11,033,000, was a complete surprise. And unpleasant. After all, this completely contradicts the logic of a recent report by the United States Department of Labor. So the growth of open vacancies rather disoriented the market. And the most important thing is that this unpleasant fact has given rise to extremely uncomfortable questions, to which there are no answers yet. Investors do not like such situations, and regard them as an increase in risk. So in general, the weakening of the dollar is quite understandable. But why was it so short-lived, and at the end of the day it did not affect the pound at all?

Number of open vacancies (United States):

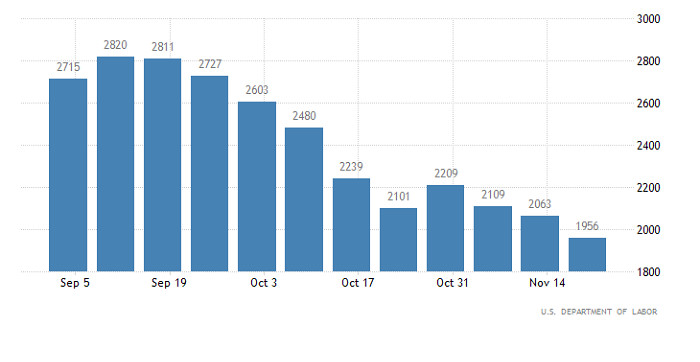

The only thing that can be said with certainty is that the market still reacts to US statistics. Based on this, it is worth considering forecasts for applications for unemployment benefits, the publication of which will clearly affect investor sentiment. Perhaps it will even remove some of the questions. The number of initial calls should increase by 3,000, which can rather be called a statistical error, and therefore not worthy of attention. In contrast to repeated calls, the number of which may decrease by 76,000, which already looks pretty good. So, if we proceed from these data, then at least from the moment of their publication, the dollar should grow.

Number of re-claims for unemployment benefits (United States):

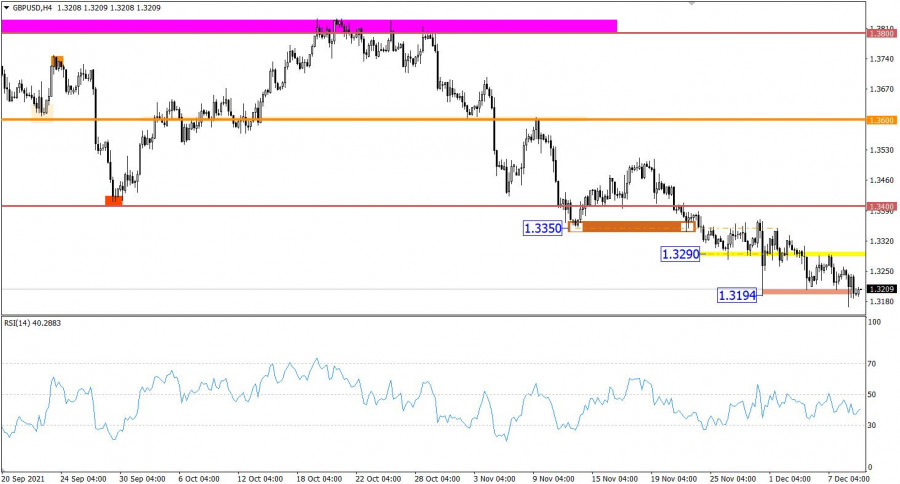

The GBPUSD currency pair, despite the renewal of the local low, continues to move within the boundaries of the 1.3200/1.3290 range. This indicates the inherent uncertainty among market participants.

The technical instrument RSI in the four-hour period follows in the lower 30/50 area, which signals high interest in short positions.

A downward trend is clearly visible on the daily chart, where at the beginning of June the pound lost more than 1000 points from value.

Expectations and prospects:

Until the quote stays below 1.3180 in a four-hour period, there is a risk of resumption of the horizontal channel at 1.3200/1.3290. This will lead to a slowdown in the downward cycle with a possible transition to the stage of correction.

In the case of a downward trend, the bears are still facing the target in the form of the psychological level of 1.3000.

Comprehensive indicator analysis gives a sell signal based on intraday and medium-term periods due to a downward trend. In the short term, technical instruments give a buy signal due to the rollback stage.

from RobotFX

Download NOW!

Download NOW!

No comments:

Post a Comment