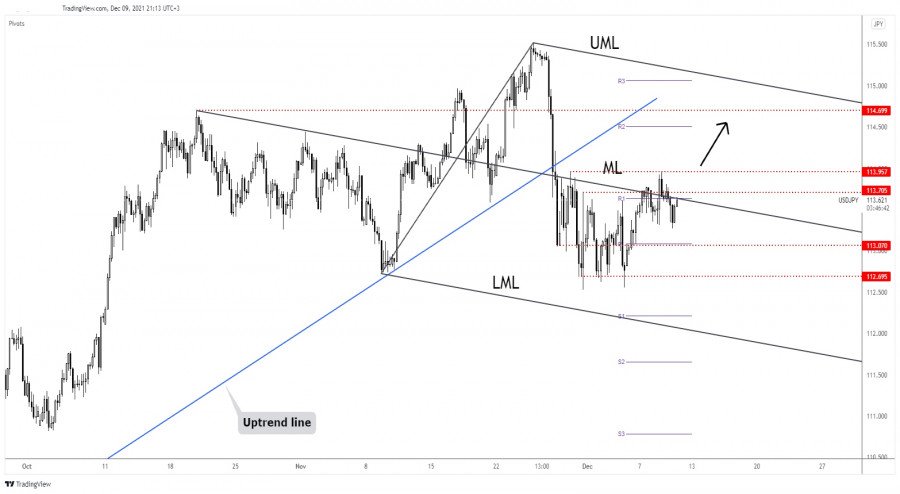

The USD/JPY pair continues to move in a major range. In the short term, the price could extend its sideways movement. Unfortunately, the price failed to confirm more gains or to stay in the buyer's territory, so a potential decline is also in the cards.

USD/JPY rebounded from 113.27 today's low as the Dollar Index has rallied and the Japanese Yen Futures could drop again. The greenback received a helping hand from the US Unemployment Claims which was reported at 184K far below 218K expected and compared to 227K in the previous reporting period.

USD/JPY Challenges A dynamic Resistance!

USD/JPY reached the 113.95 where its has found resistance, now it's located below the weekly R1 (113.63) and under the descending pitchfork's median line (ML). It continues to challenge these obstacles but the sellers could take the lead as long as USD/JPy stays below these levels.

It's trapped between 112.69 and 113.95 levels. We'll have a clear direction only after the rate escapes from this formation. A new false breakout above the median line, a new rejection could announce a new bearish momentum towards the 113.07 and down to the 112.69.

USD/JPY Outlook!

As long as it stays under the median line (ML), USD/JPY could drop deeper anytime. Only jumping and stabilizing above the median line (ML) followed by a valid breakout above 113.95 could announce a broader growth.

The material has been provided by InstaForex Company - www.instaforex.comfrom RobotFX

Download NOW!

Download NOW!

No comments:

Post a Comment