If the Federal Reserve can afford to slow down monetary expansion, why shouldn't the European Central Bank do the same? Statements from Bundesbank President Joachim Nagel suggest that, as the ECB approaches a neutral level, it should proceed with caution. Additionally, rumors of negotiations to end the armed conflict in Ukraine have helped the EUR/USD pair withstand strong U.S. inflation data and launch a counteroffensive. However, on its first attempt, the pair failed to make significant upward progress.

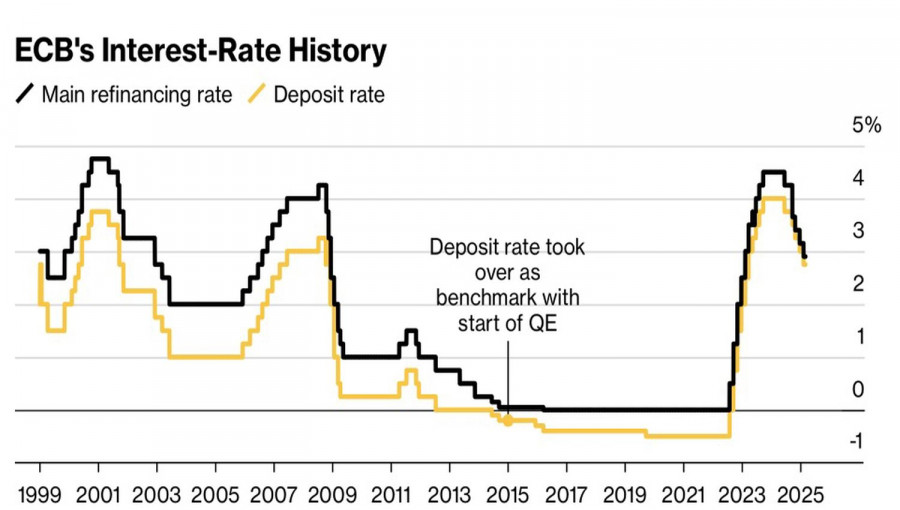

ECB Rate Dynamics

When hostilities broke out in Eastern Europe in February 2022, the euro was trading above $1.14, with expectations of continuing its rally due to recovering domestic demand after the pandemic. However, disruptions in oil and gas supplies from Russia triggered an energy crisis, prompting the EU to increase military spending while cutting back on other budgetary allocations. This led to a capital flight from Europe, causing the EUR/USD exchange rate to fall below parity by autumn 2022.

If a peace agreement is reached between Moscow and Kyiv, we could see a decline in defense expenditures, a drop in energy prices, and reduced geopolitical risks that would restore investor interest in the Eurozone. Recently, a phone conversation between the U.S. and Russian presidents sparked a rally in the euro and other European currencies.

Although this may be just the beginning of a peace negotiation process, the fact that initial steps have been taken is having a positive impact on risk assets and contributing to a weakening of the U.S. dollar, which is traditionally viewed as a safe-haven currency.

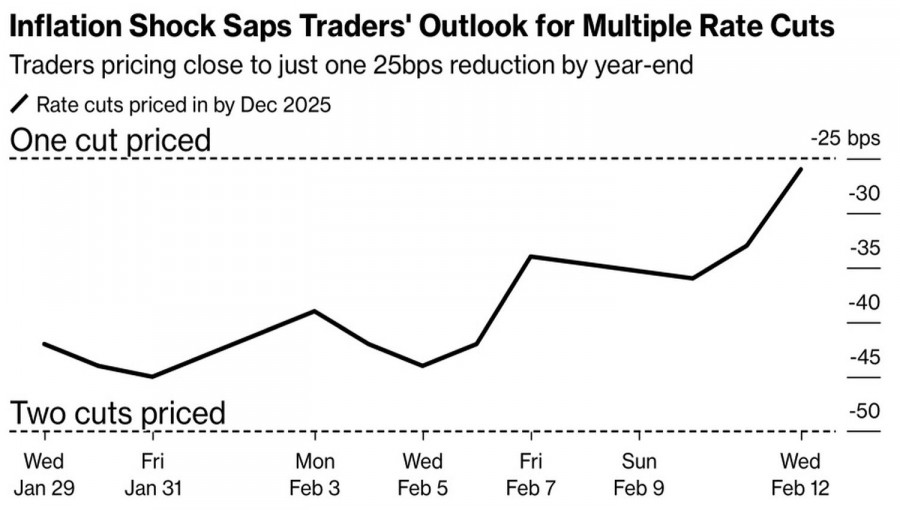

However, uncertainty remains. The positions of Moscow and Kyiv are still far apart, and Donald Trump's unpredictability means he could potentially derail the process at any moment. As a result, the upward movement of EUR/USD is unlikely to be linear. Many obstacles still lie ahead for the bulls, with significant challenges including U.S. protectionist policies and forecasts from the futures market that predict only one Fed rate cut in 2025. Notably, the December FOMC projections included expectations for two acts of monetary easing.

Market Rate Forecasts for the Fed

There is still considerable uncertainty surrounding Donald Trump's tariff policies. If the U.S. president chooses to implement reciprocal tariffs instead of universal ones, trade partners may reduce entry barriers for American goods. This could potentially accelerate international trade rather than slowing it down, benefiting the global economy and pro-cyclical currencies like the euro. Given the various possible scenarios, the EUR/USD pair is likely to remain in a medium-term consolidation until more clarity emerges.

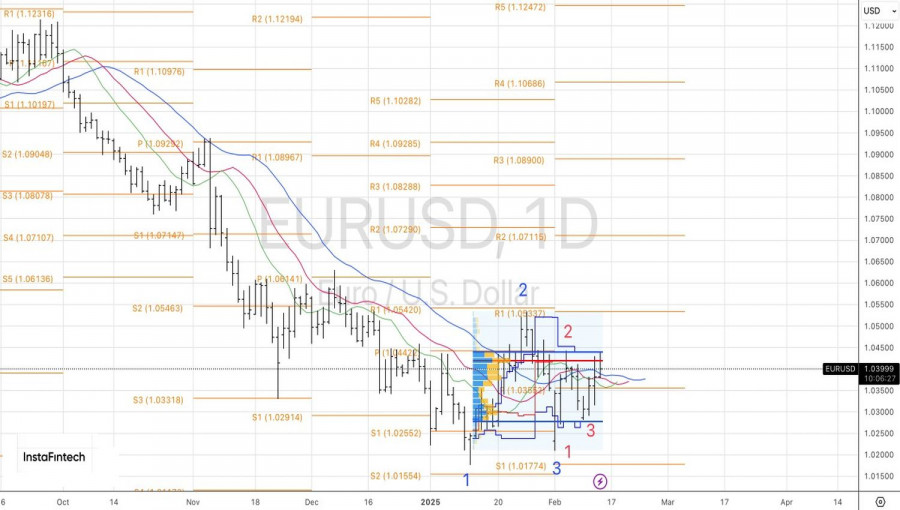

From a technical perspective, the daily EUR/USD chart indicates that bullish traders attempted to activate a minor 1-2-3 pattern to extend the correction. The first attempt to break resistance at 1.0435 was unsuccessful; however, a successful second attempt could present long opportunities. Conversely, if the price drops below the pivot level of 1.0355, it would signal a return to short positions.

The material has been provided by InstaForex Company - www.instaforex.comRobotFX

Download NOW!

Download NOW!

No comments:

Post a Comment