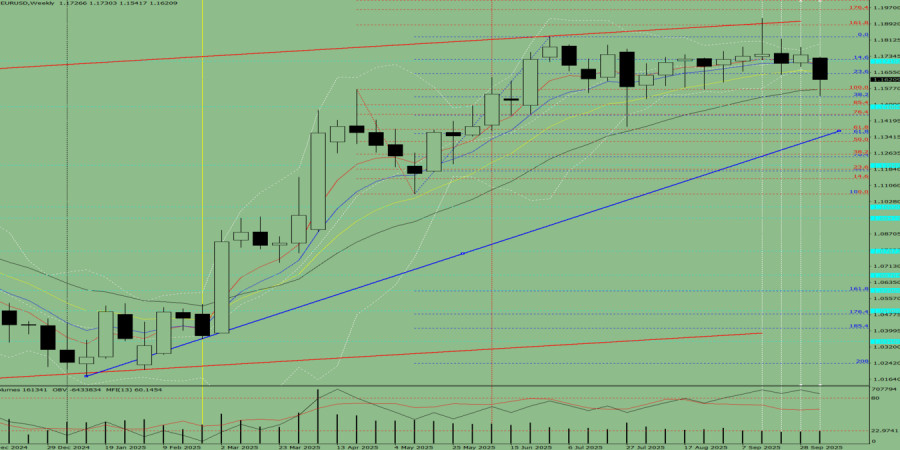

Trend Analysis (Fig. 1)This week, from the level of 1.1621 (the closing price of the last weekly candle), the market may continue to move downward, aiming for 1.1488 — a historical support level (light blue dashed line). When testing this level, the price may bounce upward toward 1.1536 — the 38.2% retracement level (blue dashed line).

Figure 1: Weekly Chart

Comprehensive Analysis

- Indicator analysis – downward;

- Fibonacci levels – downward;

- Volumes – downward;

- Candlestick analysis – downward;

- Trend analysis – downward;

- Bollinger Bands – downward;

- Monthly chart – downward.

Conclusion of comprehensive analysis: downward movement.

Overall Summary for the Weekly EUR/USD Candle

Throughout the week, the price is most likely to show a downward trend, with no upper shadow on the weekly black (bearish) candle (Monday — down) and a lower shadow forming by Friday (Friday — up).

Alternative Scenario

From the level of 1.1621 (closing price of the last weekly candle), the pair may continue its downward movement toward 1.1447 — the 50% retracement level (blue dashed line). Upon testing this level, the price may start moving upward, targeting 1.1488 — the historical support level (light blue dashed line).

The material has been provided by - RobotFX.Org

Download NOW!

Download NOW!

No comments:

Post a Comment