To open long positions on EURUSD you need:

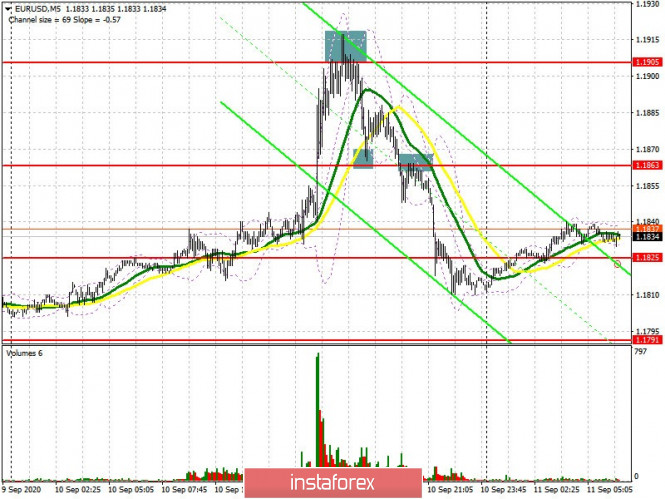

The sharp rise in the euro following the European Central Bank's decision to leave monetary policy unchanged, together with ECB President Christine Lagarde's speech, led to updating the large resistance level of 1.1905, above which it was not possible to gain a foothold. Three signals to enter the market appeared at once in the afternoon, let's deal with them. The 5-minute chart shows how an unsuccessful attempt to go above the 1.1905 resistance led to forming a false breakout and a signal to sell the euro. Also, in yesterday's review, I recommended opening long positions when the pair returns to the support area of 1.1863, which is what happened. However, it was not possible to extend the bullish market, and EUR/USD falling below 1.1863 formed a good signal to sell the euro, which caused the pair to drop to the support area of 1.1825, where it all ended. Now the technical picture has slightly changed. The bulls should return resistance at 1.1854 in the morning, consolidating on which forms a good entry point to long positions in the hope of returning to resistance at 1.1905, which is where I recommend taking profits. The 1.1949 level will be the long-term goal. If the euro is still under pressure in the first half of the day once weak inflation data in Germany is released, then it is best to postpone long positions until a false breakout forms in the 1.1800 area, or buy EUR/USD only immediately to rebound from the low of 1.1756, counting on a correction of 20-30 points within the day.

Let me remind you that the Commitment of Traders (COT) reports for September 1 showed long non-commercial positions decreasing from 262,061 to 250,867, while short non-commercial positions increased from 50,309 to 54,130. The euro rose to new annual highs and the bulls' inability to break through the area above the 20th figure, which we clearly saw earlier this month, resulted in a sharp closure of long positions and profit taking by traders, as well as a build-up of short ones. As a result, the positive non-commercial net position slightly decreased to 196,747, against 211,752 a week earlier. However, traders will see any major decline in the euro as a good level to build up long positions in the medium term.

To open short positions on EUR/USD, you need:

The bears will count on a false breakout in the resistance area of 1.1855 in the first half of the day, which will be the first signal to sell the euro in order to return to the middle of the side channel of 1.1800. Weak data on German inflation can provide help, which is expected in the morning. Settling below 1.1800 will increase pressure on the pair, which will lead to a retest of the channel's lower limit at 1.1756. Consolidating below this range would open a direct road to the lows of 1.1714 and 1.1648. This scenario also forms a new downward trend. If the bulls continue to push the pair up and try to seize the initiative at the 1.1854 level, it is best not to rush to sell, but wait until the high of 1.1905 has been updated and a false breakout appears there, or sell EUR/USD immediately on a rebound from the larger resistance of 1.1949, counting on a correction at 20-30 points within the day.

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates long term confrontation between buyers and sellers.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the D1 daily chart.

Bollinger Bands

If the pair drops, support will be provided by the lower border of the indicator at 1.1800. Growth will be limited by the upper level of the indicator in the 1.1890 area.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

Download NOW!

Download NOW!

No comments:

Post a Comment