British Pound. Weekly Preview

Over the past two weeks, the pound has declined more than the euro, yet the wave patterns of both instruments are almost identical. Accordingly, a three-wave corrective structure should also be expected for the pound, as I've noted throughout the week. As we can see, the news background over the past five days has had virtually no impact on the wave structure or market sentiment. If market participants had reacted to the news from the White House, we likely wouldn't have even seen a minor corrective wave.

The market will struggle to resist the news backdrop and push the dollar downward. For now, the U.S. currency is only being supported by the fact that all updated tariffs are set to take effect only from August 1. Over the next three weeks, trade agreements could be signed between the conflicting parties, which might lead to a reduction in tariffs. Of course, this remains speculative, especially given the current pace of deal-making. However, the market has chosen not to jump to conclusions yet.

I believe that in August, there's a higher chance of yet another postponement of the new tariffs' implementation. Donald Trump may again announce an amnesty for the "offending" countries and grant them a few more weeks to negotiate. However, the U.S. president cannot keep extending the deadline forever, and tariffs on copper, pharmaceuticals, and semiconductors are not subject to negotiation.

Inflation, unemployment, and wage reports will be released in the UK. In my opinion, the inflation report will be the most important, as it has been accelerating recently. The Bank of England has already acknowledged this, and Andrew Bailey hinted that monetary policy easing will not be implemented in the near term. Inflation is expected to reach 3.4% year-on-year for June, which matches May's figure. Therefore, the situation is unlikely to change significantly enough to warrant a shift in the BoE's policy stance.

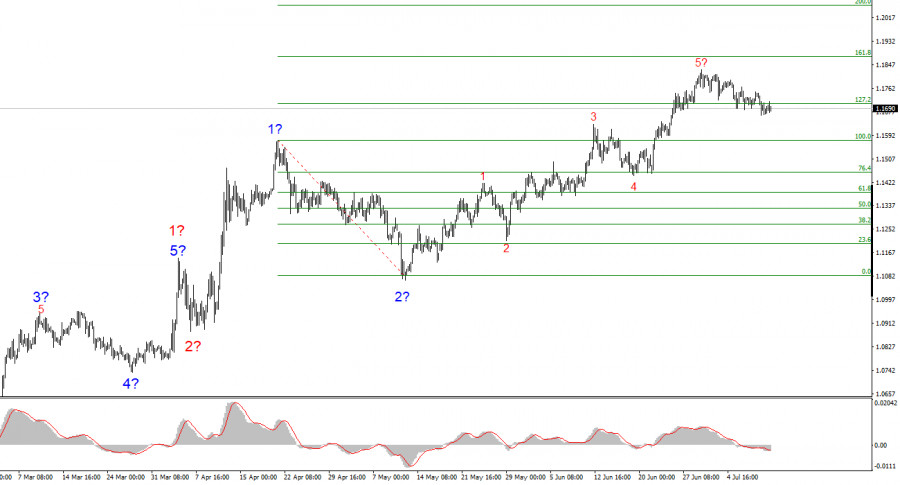

Wave Pattern for EUR/USD:

Based on the EUR/USD analysis, I conclude that the instrument continues to build a bullish trend segment. The wave pattern still entirely depends on the news backdrop related to Trump's decisions and U.S. foreign policy, and there are still no positive changes.

The targets of the trend segment may extend to the 1.2500 area. Therefore, I continue to consider buying, with targets around 1.1875, which corresponds to 161.8% Fibonacci. A corrective wave structure is expected to develop soon, so new euro purchases should be considered after its completion.

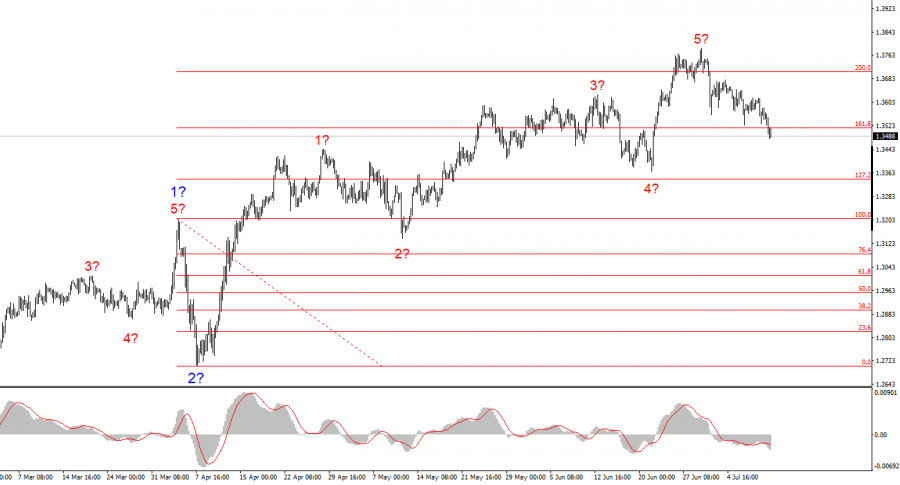

Wave Pattern for GBP/USD:

The wave pattern of the GBP/USD instrument remains unchanged. We are dealing with a bullish, impulsive trend segment. Under Trump, the markets may face many more shocks and reversals, which could seriously affect the wave structure, but for now, the working scenario remains intact.

The targets of the bullish trend are now located around 1.4017, which corresponds to 261.8% Fibonacci of the assumed global wave 2. A corrective wave structure is now presumably forming. Classically, it should consist of three waves.

Core Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are hard to trade and often shift.

- If you're uncertain about market conditions, it's better to stay out.

- There is never 100% certainty in market direction. Always use protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.

Download NOW!

Download NOW!

No comments:

Post a Comment