U.S. Dollar. Weekly Preview

In the upcoming week in the U.S., reports on inflation and industrial production will be released, along with a few other moderately interesting indicators. The most important one is undoubtedly inflation. However, in my opinion, this indicator currently does not influence the Federal Reserve's monetary policy. In recent months, Jerome Powell and many of his colleagues on the FOMC have repeatedly stated that they are not ready to make any radical decisions regarding interest rates in the near future. The Fed continues to adopt a wait-and-see approach because no one in the world right now can say with certainty what the final import tariffs to the U.S. will be, which countries will sign trade deals, and which other sectors Donald Trump will decide to impose tariffs on. Let me remind you that tariffs are already in place on automobiles, steel, and aluminum. Starting August 1, new ones will apply to copper and pharmaceuticals. These tariffs are not going away.

Therefore, whether U.S. inflation rises or falls, it hardly matters. The Fed still plans to implement two rounds of policy easing in 2025, and one round each in 2026 and 2027. Of course, next year, when Powell retires, the situation may change slightly, but not within the coming year. As of now, only two out of 19 FOMC members support easing at upcoming meetings. And these two are proteges of Trump, as dramatic as that may sound. One of them is even a candidate to become Fed Chair.

In my opinion, even the new tariffs imposed by the U.S. president will not significantly impact the dollar exchange rate, since the market has demonstrated this week that it is focused on building a corrective wave structure. However, this outlook carries risk. No one knows when the majority of market participants will decide that the current correction is enough. After all, the news backdrop hasn't started supporting the U.S. dollar. Therefore, the decline in the dollar may resume sharply and unexpectedly for many. I am not currently considering short positions on EUR/USD or GBP/USD.

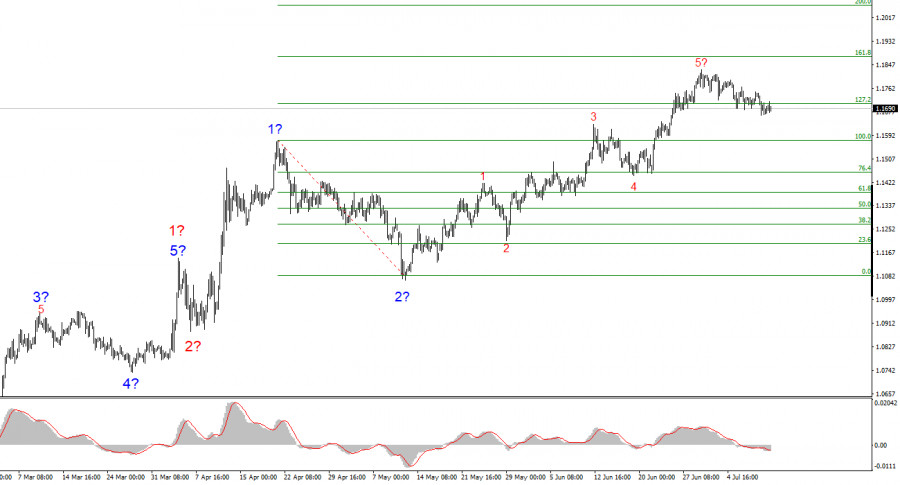

Wave Pattern for EUR/USD:

Based on the EUR/USD analysis, I conclude that the instrument continues to build a bullish trend segment. The wave pattern still entirely depends on the news backdrop related to Trump's decisions and U.S. foreign policy, and there are still no positive changes.

The targets of the trend segment may extend to the 1.2500 area. Therefore, I continue to consider buying, with targets around 1.1875, which corresponds to 161.8% Fibonacci. A corrective wave structure is expected to develop soon, so new euro purchases should be considered after its completion.

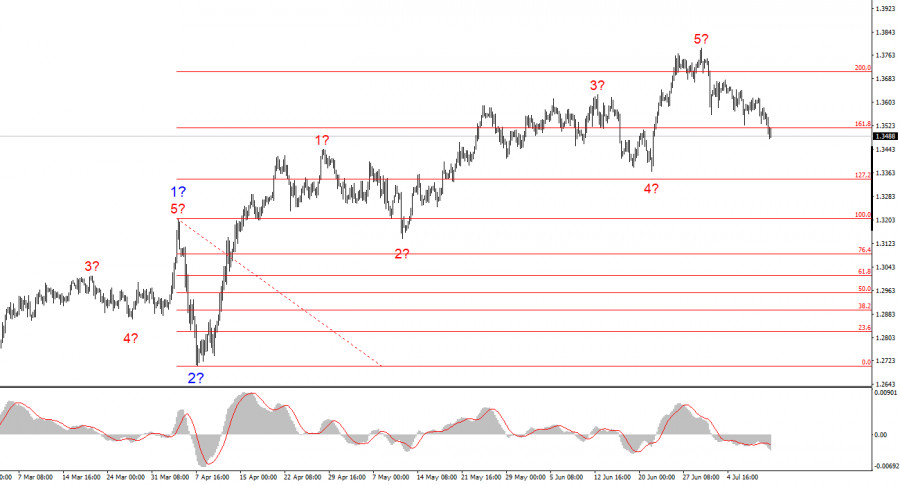

Wave Pattern for GBP/USD:

The wave pattern of the GBP/USD instrument remains unchanged. We are dealing with a bullish, impulsive trend segment. Under Trump, the markets may face many more shocks and reversals, which could seriously affect the wave structure, but for now, the working scenario remains intact.

The targets of the bullish trend are now located around 1.4017, which corresponds to 261.8% Fibonacci of the assumed global wave 2. A corrective wave structure is now presumably forming. Classically, it should consist of three waves.

Core Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are hard to trade and often shift.

- If you're uncertain about market conditions, it's better to stay out.

- There is never 100% certainty in market direction. Always use protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.

Download NOW!

Download NOW!

No comments:

Post a Comment